- Home

- :

- Resources

- :

- Admin Resources

- :

- Exploring Solutions

- :

- Mexican Requirements for Global Companies

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

Mexican Requirements for Global Companies

- Subscribe

- Bookmark

- Report Inappropriate Content

Many global companies with headquarters in the United States, Europe or Asia mainly, are unaware of the complexities they must take into account when expanding or working with their branches in Mexico. This article will help you to understand the main issues that a Mexican company would need to comply with when implementing the configuration policy for Mexico in the global entity of SAP Concur. You should always review your specific needs with your local accounting team.

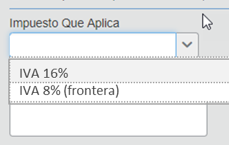

- The local Value Added Tax rate currently is 16% but this is changing in 2019 since those cities near the north border like Tijuana, would have an 8% of VAT rate. Within SAP Concur tax administration module, it can manage both VAT rates according the city in which the expense was incurred.

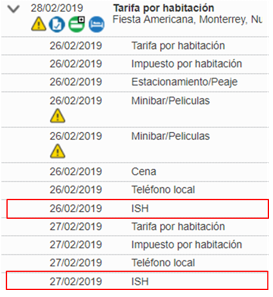

- There are special taxes: Hotel, Gas and Airfare that should be set up as an expense type since they have a specific accounting code number.

The Hotel has an ISH (Impuesto Sobre Hospedaje) tax per night, Gas has the IEPS (Impuesto Especial sobre Producción y Servicios) tax and airfare has the TUA (Tarifa de Uso Aeropuerto), those are not regular % calculations but are included in the xml invoice, mainly the CFDI (Comprobante Fiscal Digital). Then the users should itemize all local expenses for this expense types and type the amounts for these taxes, the VAT can´t be calculated from the total because the total amount includes these taxes. Itemization templates can help to let know the user that they have to include it and have the VAT calculated from the remaining amount.

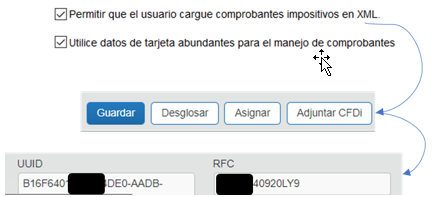

- Within the expense report, for each line item, you have to include the UUID (universally unique identifier) of the xml invoice and the vendor tax id at least, so this is done when you attach a CFDi (xml) file into the line item expense automatically, and it will appear in the SAE or if using the native SAP connector, it would be a custom field you should take into the ERP using BADIS development. To activate the XML attachment feature, it is activated at the group level of the expense admin.

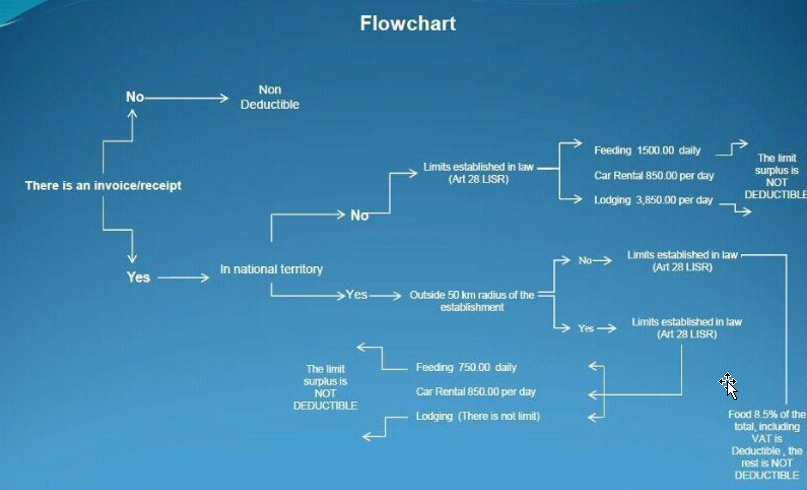

- Last but not least is the deductibility. This table help to explain basically how to apply deductibility (check with your local accounting department to be sure that you have the updated amounts). Many customers apply some rules to the bridge program, middleware or use Badis (Business Add-Ins) if the SAP native connector is used to get this done.

This is an example (always review the latest updates with your local accounting team)