- Home

- :

- Resources

- :

- Admin Resources

- :

- Exploring Solutions

- :

- Payment Type Differences in Accounting Extracts

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

Payment Type Differences in Accounting Extracts

- Subscribe

- Bookmark

- Report Inappropriate Content

When you're getting ready to set up the Payment Type for your Company Paid credit card, there's a crucial decision to make. You'll need to pick a Payment Type Code, but don't worry – it's not as complex as it sounds. For Company Paid credit cards, there are a few options available:

- Individual Billed/Company Paid (without reimbursement offsets)

- Individual Billed/Company Paid (with reimbursement offsets)

- Company Billed/Company Paid (with reimbursement offsets)

- Company Billed/Company Paid (without reimbursement offsets)

This article assumes you have a basic grasp of the differences between "Individual Billed/Company Paid" (IBCP) and "Company Billed/Company Paid" (CBCP), and it zooms in on the concept of 'offsets'. Each card type (IBCP and CBCP) can be set up with or without 'offsets', which essentially means dealing with personal expenses that won't be reimbursed. The 'offsets' choice lets you define how the system will handle these types of expenses on your corporate card.

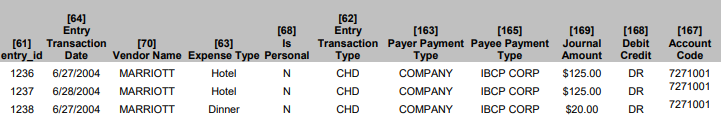

- Individual Billed/Company Paid (without reimbursement offsets)

This is the usual setup for IBCP card programs. In simple words, if you choose this, any personal spending on your corporate card won't be considered for payments. Your card vendor gets paid for approved charges, but anything that isn't approved is your responsibility to pay directly to the vendor. Those personal, non-reimbursable expenses won't show up in your payment records. Only the charges that got the green light will be noted.

Remember, this 'offset' choice affects how payments work. The payment report will show what you're owed as well as what you owe to the vendor. Your user interface will reflect this choice.

Now, let's see it in action with a real-life scenario:

Scenario: You've got a corporate card transaction, a $284.00 hotel expense. This covers a two-night stay at $125 per night, plus a $20 dinner and a $14.00 in-room movie – which, by the way, the company won't reimburse you for. The expense report has these details laid out. Everything is legitimate, except the non-reimbursable movie, which you mark as personal.

Payment Details: The company pays the card vendor for you. The type of transaction is 'CHD' due to the itemized nature. Since it's IBCP and you've marked the personal expense, the non-reimbursable movie cost is taken out. The rest of the expenses stay, marked as 'N' for business. Since it's IBCP, you won't get reimbursed for this, as the payment goes directly to the vendor.

So, when you see IBCP 'Without Offsets,' think of it as the company paying most of the bills, but if you go off-book with personal stuff, you handle those directly.

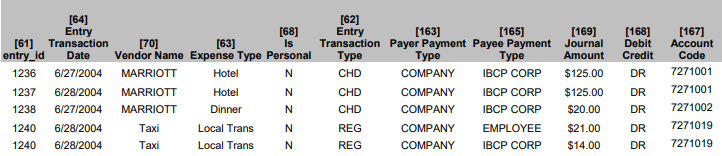

- Individual Billed/Company Paid (with reimbursement offsets)

Under this setting, if you've got personal charges on your company card, the company pays the card vendor for them. But here's the twist: the personal amount gets 'offset' against what you're owed in out-of-pocket expenses.

Companies choose IBCP 'With Offsets' to make things smoother for you. If your personal charges stay under what you're owed out-of-pocket, no worries about direct payments. But remember, if the offset's used up, you need to pay any balance to the vendor. Missing this could mean extra charges.

Scenario: You've got a $284 hotel expense, $20 dinner, and a $14 non-reimbursable in-room movie (the company won't cover that). Plus, you've got an out-of-pocket $35 taxi expense.

Payment Details: Company pays the vendor for the hotel and dinner (business expenses). For the in-room movie, they'll cover it up to your out-of-pocket limit. Since $14 < $35, they'll pay $14, offsetting it against the taxi expense. You'll get $21 of the taxi expense, making a net due to you.

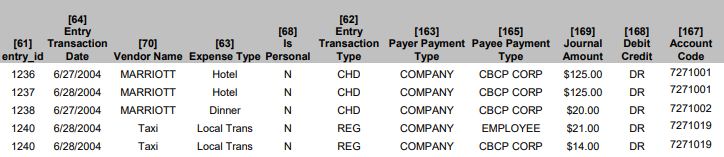

- Company Billed/Company Paid (with reimbursement offsets)

This used to be the go-to setting for CBCP card programs, and not too long ago, the 'Without Offsets' wasn't even an option. Under the 'With Offsets' setup, your payment records were carefully checked to remove any personal, non-reimbursable expenses (that 'Is Personal' column = 'Y'). This was done by splitting an approved expense, showing the offset (trust us, it's like a virtual balance).

But here's what's cool – this 'offset' choice doesn't change how payments are made. Your 'Report Totals' will look the same whether offsets are on or off. So, no worries about the user interface – it's business as usual. The only thing that changes is how stuff is shown in your payment records.

Let's see it in action:

Scenario: You've got a $284 hotel expense, a $20 dinner, and a $14 non-reimbursable in-room movie (company won't cover that). Plus, you've got an out-of-pocket $35 taxi expense.

Payment Details: Company owes the full hotel amount to the card vendor (including the movie). For the taxi, you're usually owed $35, but because of the non-reimbursable movie, the system brings this down. So, you're still owed something, but a bit less.

Remember, 'With Offsets' is like having a buddy watching your balance, making sure personal stuff doesn't mess up what you're owed. It's about keeping things fair.

So, when someone mentions CBCP 'With Offsets,' think of it as a smart way to handle personal stuff within limits, without confusing your payment records.

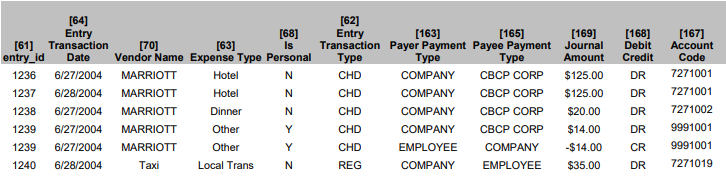

- Company Billed/Company Paid (without reimbursement offsets)

Here's the scoop on 'Without Offsets' – a setting for CBCP that's straightforward:

This choice doesn't change how you get paid, and your 'Report Totals' stay the same, whether you're using offsets or not. Your user interface doesn't change because of this. The only thing it affects is how your info shows up in the records.

Take a look at how it works:

Scenario: You've got a $284 hotel expense, a $20 dinner, and a $14 non-reimbursable in-room movie (company won't cover that). Plus, you've got a $35 taxi you paid yourself.

Payment Details: Let's talk about the hotel bill. Instead of virtual offsets, each part of your expenses is shown clearly. Your in-room movie has two parts – what the company owes the vendor and what you owe the company. For the taxi, it's straightforward – you're owed that amount.

Remember, 'Without Offsets' keeps it simple, showing each piece of your expenses individually.