- Home

- :

- Forums

- :

- Concur Expense

- :

- Personal Expenses

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Personal Expenses

Hi,

I have used company's AMEX card for personal expenses and when I selected (Personal Expenses) as a main category and I ticked the box for (Personal Expense) within the expense and tried to submit I got the below error message:

(This report has a cash advance and/or personal amount due the company. Please add any out-of-pocket expenses pending or a 'Cash Advance Return' Expense Type to the report for the amount owed and send in the payment. )

Can someone advise what is the exact procedure to complete the above?

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

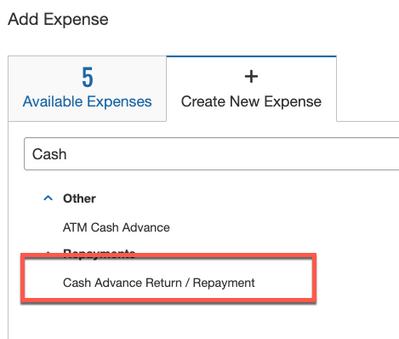

@engineer2020 from the description, you need to add a new expense to your report using the Cash Advance Return / Repayment Expense type.

See my screenshot. The amount should be $67.17. This indicates the amount of the two personal expenses on the report.

Thank you,

Kevin Dorsey

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Thanks Kevin,

I got the following error:

The Cash Advance Return/Repayment Expense Type cannot be selected for credit card expenses

Also what do I follow up the following:

- Payment Number

- Issuing Bank Name?

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@KevinD can you please advise on the above as Im running out to close the expense. thanks in advance.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@engineer2020 question for you...are all the expenses on this report purchases from your company card?

I'm asking because from the sounds of the message you received, your company pays themselves back from money owed directly to employees. For example...I don't have a company card and all my expenses are out of pocket. The company would owe me for all those expenses. Now let's say I have a company card and marked one expense as personal in the amount of $50. On this same report I did have some expenses that I paid for on my own credit card because the vendors didn't accept my corporate card. These expenses total $100. So, when processing my expense report, the company only pays me $50 out of the $100 I submitted as out of pocket, because of the $50 company card expense I marked as personal. The company "took their cut" so to speak to pay themselves back for the $50 company card charge I marked as personal.

I think what you need on this expense report is some out of pocket expenses to offset the company card charge you marked as personal. If you don't have any, then you should use the Cash Advance Return expense type and enter the amount. So, change the expense type from Personal, to Cash Advance Return and then you will need to send your company a payment for the amount of the expense.

Thank you,

Kevin Dorsey

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.