- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Personal expense error

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Personal expense error

Hi

I purchased a travel meal in a shop along with one personal item on the same receipt. I used my debit card as I couldn't use my corporate card. I have added the expense to my report and itemised the receipt, ticking the box for the one personal item, but I have an error.

WARNING: The 'Personal Expense' box is checked for this entry or portion of entry. As such, no reimbursement will process for that amount. Action to avoid a past due: 1) pay the credit card directly for the charge, and 2) attach the pay evidence image for a proper reconciliation audit trail.

Next time I will put these through as 2 transactions, but how can I move past the error code when I don't need to pay the corporate card as it was purchased on my personal debit card?

TIA

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi Tia,

The personal expense checkbox is used for corporate card transactions.

If you have paid using the personal debit card and it is a personal item then you don't need to add to your expense claim or select the checkbox personal expense.

Thanks

Innovel Consulting

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@MissH I second what @Innovel said. The amount of the personal expense did not need to be included in the amount you entered for the entry. Likely you wanted the amount to match the amount of the receipt, but most companies don't have issues when the receipt total is higher than what the user is claiming for reimbursement. 🙂

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

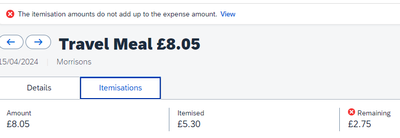

Thankyou for the replies - I went straight away to the claim and removed the line for personal expense and it said the claim now does not add up - this is because I added the full receipt of £8.05. However only claiming for £5.30 means I haven't accounted for £2.75 and its added a red alert.

Adding the full receipt price seemed the right thing to do but do I only need to state £5.30? Basically do I ignore the £2.75 altogether? I had already itemised it, hence the snip below, but I can also remove that if necessary.

TIA - My statement is through from Amex so I would like to get this through the audit process first time if possible!

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Yes, you should remove the 2.75 personal expense from itemisations and from the expense total. For out-of-pocket expenses you should only include the amount for which you are claiming reimbursement.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Thanks to everyone for their help with this 😀