- Home

- :

- Resources

- :

- Admin Resources

- :

- Maximize Your Solutions

- :

- Sales and Use Tax

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

Sales and Use Tax

Sales and Use Tax with a California Example

Below is a concept in theory:

Tax is a complex issue. Many different countries handle them in many different ways. European countries have VAT tax, Canada has GST and HST, Australia has Fringe benefit tax etc. Creating a mechanism to account for tax is tough. Making this information consumable to an end user can further complicate this issue.

Sales and Use Tax is an issue in many states when it comes to Invoice management and paying vendors. Concur has .

It is also quite a big issue when Pcards for expenses are concerned. I noticed this firsthand when working with a client in California.

Let’s talk about what sales and use tax means. If you buy something and there is no sales tax on the item (e.g. Amazon purchase), you may owe use tax on this good. Even if there was sales tax on this good, it needs to match up with the tax rate of the local jurisdiction or else there needs to be an accrual.

Users without Concur are manually specifying today if their Pcard transactions contain sales tax. The administration has to calculate what the use tax would be for a specific item and a specific tax jurisdiction.

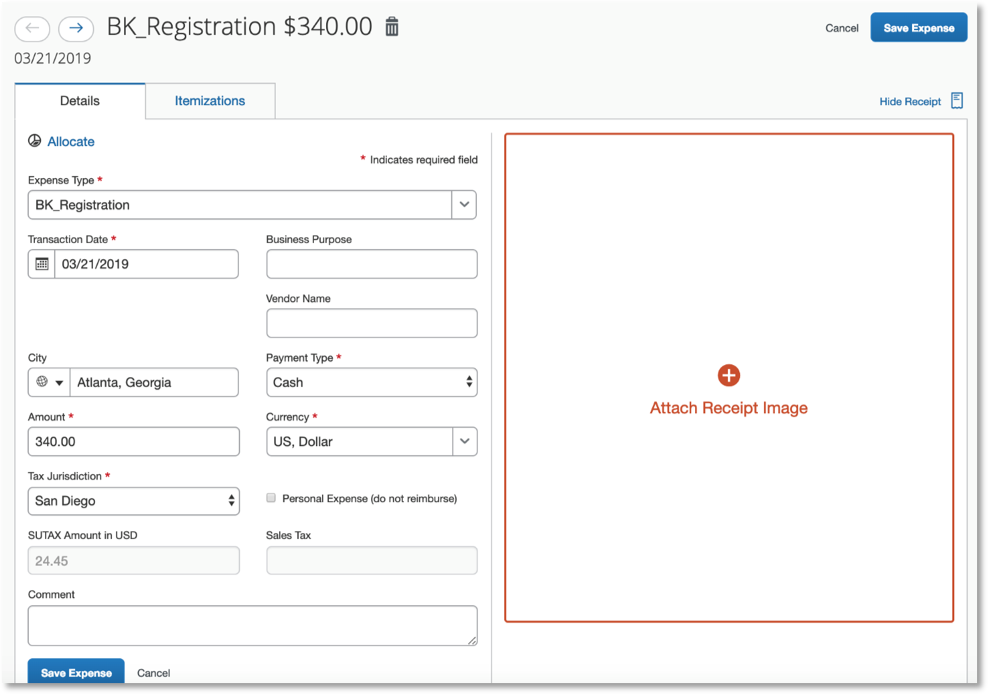

Concur’s tax administration feature can help shine a light on use tax for a specified good from the Pcard without the end user needing to perform any calculations.

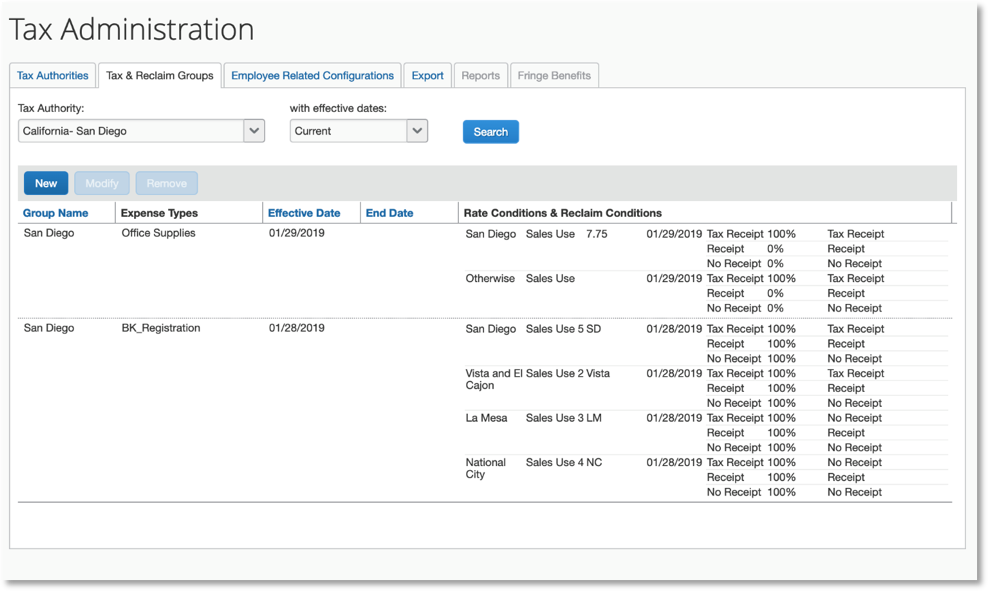

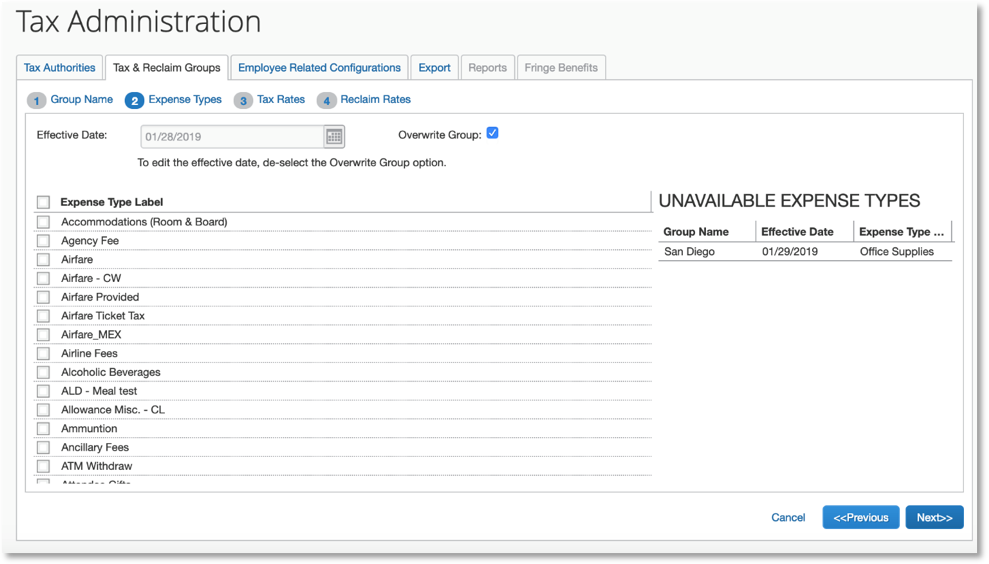

Concur is able to specify a given expense type (which can be mapped from a Pcard merchant category code for taxability. Concur can factor a given tax percentage against the appropriate expense type for the appropriate tax jurisdiction.

This information gets setup from an administrative perspective so that Concur can do the calculation for the user. The user simply needs to apply the correct attachments and treatments to a given expense type and Concur can apply the configured use tax for a given expense.

Differential reporting is available to identify if enough sales tax was applied to a certain good. This is key to identifying the correct sales tax was paid for a particular region. Reporting is able to help in keeping up with ongoing tax accruals.

This process can reduce hours of manual calculation for both the end user and the administration while keeping in line with tax liabilities. This is a feature that is within Concur and is available today for all Concur Expense clients. Concur’s focus is to take you beyond automation meaning you will have a solution that is robust enough to tackle the problems of today and tomorrow.

Please consult your internal tax team to validate your tax needs. For more information regarding tax, contact Concur Support or your Service Administrator for help around this subject. For more in depth reading please visit: https://www.concurtraining.com/customers/tech_pubs/Docs/_Current/SG_Exp/Exp_SG_VAT.pdf