- Home

- :

- Resources

- :

- Admin Resources

- :

- Getting Started

- :

- Ensure Those Personal Expenses are Paid Back

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

Ensure Those Personal Expenses are Paid Back

- Subscribe

- Bookmark

- Report Inappropriate Content

Personal expenses on corporate credit cards seem to be a common occurrence in many organizations, whether they are accidental purchases or things like paying an entire cell phone bill but only a portion is business related. As these personal expenses come into Concur they get harder and harder to track and becomes an unwanted and non-value add function for Concur administrators.

Thankfully there are ways to minimize this tracking and ensure employees are paying for their personal expenses. Dependent on the type of card program, there are different ways to ensure cardholders reconcile their personal purchases. If Individually Billed Individually Paid (IBIP) or Individually Billed Company Paid (IBCP), these card programs put the liability on the cardholder themselves and there is little to no impact to the organization if the cardholder does not pay personally.

However, if the card program is Company Billed Company Paid (CBCP) the organization will lose that money if it is not offset against out of pocket reimbursables or paid back to the organization by the cardholder.

Instead of tracking down employees to submit checks and the constant report running to see who has outstanding amounts, let’s let Concur handle.

Concur has a function, called Cash Advance Balance Carry Forward, it serves two purposes. First, it allows a user to carry a cash advance balance forward to additional expense reports, supporting scenarios where not all of a cash advance is consumed by expenses on a single report. The expense filer still has the option to return the remaining balance. Second, it allows companies that utilize CBCP card programs to track personal purchases on the CBCP card as cash advances, then record the return of the cash advance.

How it works.

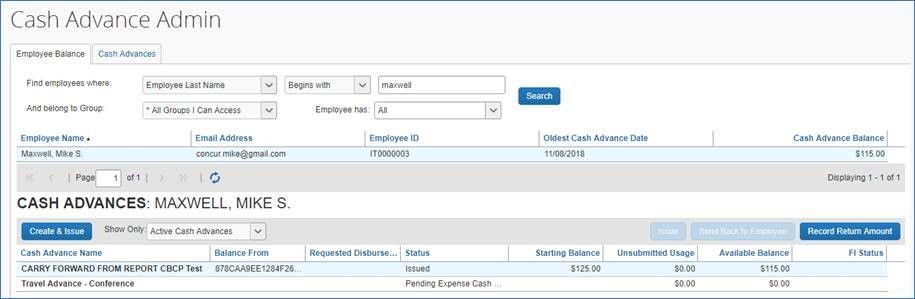

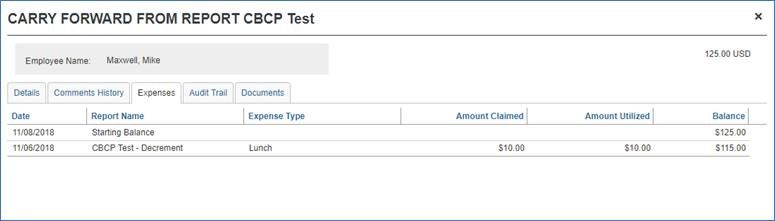

When a user creates an expense report with a CBCP card, and they mark a card purchase as Personal, the system will automatically create a Balance Carry Forward Cash Advance which will show up in the Cash Advance Administrator tool. The Cash Advance name will use the following syntax: CARRY FORWARD FROM REPORT Original Report Name'.

Appropriate lines will appear in the client’s standard accounting extracts (SAE) to ensure journal entries are correct.

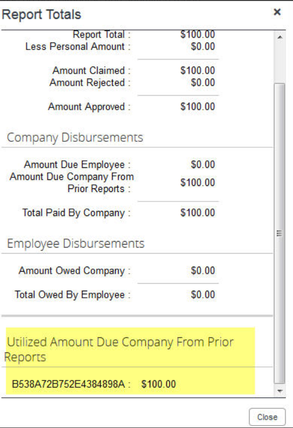

When the user creates a new expense report that have Cash/Out of Pocket expense entries, the Balance Carry Forward Cash Advance will be decremented, and the balance will be updated.

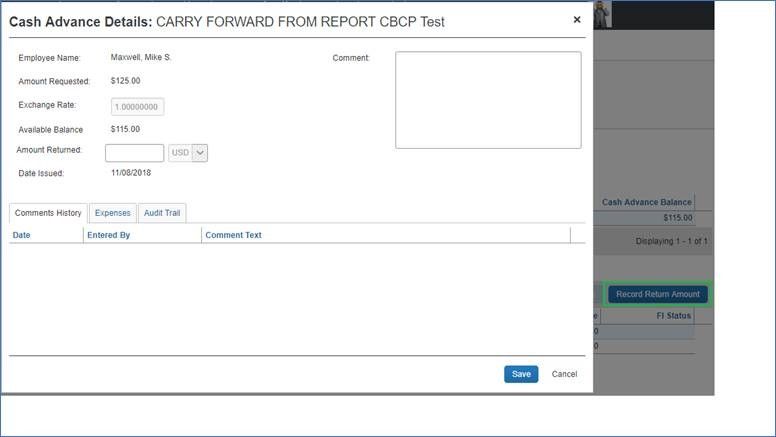

When the employee returns the outstanding balance (such as by writing a check to the company for the Personal Amount), someone with the Cash Advance Administrator permission can capture the return of the outstanding balance as he/she would for other Cash Advances.

Appropriate journal entries will appear in the Standard Accounting Extract to reflect the creation of the employee liability to the organization, as well as the changes to the balance.

When a user has a balance carried forward from a previous expense report they will see the below when submitting the next report.

Utilizing this function in Concur could eliminate the need for employees to submit checks while still recouping all monies owed by offsetting future reimbursements against the amount owed. Additionally, it will allow for simple reporting on any and all outstanding balances owed to the organization.

Want to learn more? Please contact your internal Concur Administrator for further information. If you are the Concur Administrator, please contact your SAP Concur Client Executive.