- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Re: Unable to submit a claim

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Unable to submit a claim

Good Morning,

I am unable to submit a claim to due 2 reasons.

a red circle with an exclamation mark

this has N/A in front of it. then says

this report has a net credit amount due employee, please hold the credit(s) until you have out of pocket entries to offset.

and a yellow triangle warning. in front it says,

Gifts - Staff and after it reads - Warning. Standard VAT is reclaimable only if less than £50 (gross). Only applicable where the total cost of all client gifts does not exceed £50 in any given tax year and this is not a part of series of gifts.

Can you assist please?

The gift is for £50 as it was for a competition for staff.

Solved! Go to Solution.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

The first alert is saying that the claim total is less than zero - did you have a refund in this report? If so, Concur can only accept claims that are over zero so that it can process them. Even if you delete the refund from this report, this alert will still show in some cases. It may be best to start a new claim without the refund in it, or wait until you have enough standard transactions to exceed the amount of the refund.

The yellow triangle is only a warning and you can submit the claim even with this - it is the red alert that is stopping you from being able to submit.

Best,

Travel and Expense System Administrator

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@NMTyres192 @JessicaL is spot on with her reply. You either need to delete the entry with the negative amount or wait until you incur more business expenses that will exceed the amount of the credit.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hello, I'm hoping someone can help me. I have the same issue with a negative -$29.24 net credit amount. Uber charged me on the wrong card but I was able to reverse the expense and pay on my personal card but since then I have this reminder every day. I have tried deleting the report and I have used the credit card since thinking that would offset the amount but to no avail.

Any thoughts here? Thank you.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

The first alert is saying that the claim total is less than zero - did you have a refund in this report? If so, Concur can only accept claims that are over zero so that it can process them. Even if you delete the refund from this report, this alert will still show in some cases. It may be best to start a new claim without the refund in it, or wait until you have enough standard transactions to exceed the amount of the refund.

The yellow triangle is only a warning and you can submit the claim even with this - it is the red alert that is stopping you from being able to submit.

Best,

Travel and Expense System Administrator

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@NMTyres192 @JessicaL is spot on with her reply. You either need to delete the entry with the negative amount or wait until you incur more business expenses that will exceed the amount of the credit.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hello, I'm hoping someone can help me. I have the same issue with a negative -$29.24 net credit amount. Uber charged me on the wrong card but I was able to reverse the expense and pay on my personal card but since then I have this reminder every day. I have tried deleting the report and I have used the credit card since thinking that would offset the amount but to no avail.

Any thoughts here? Thank you.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Yatesie the system does not allow for a negative amount expense report. You'll need to wait until you have other company card charges come in, add them to this report so they will offset this negative amount.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

That makes sense now! Thank you.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hello Kevin, Does this mean we cannot tie the Concur report with the credit card statement? Say I have $100 purchase, $200 refund for the period. The credit card statement would show ($100 credit)=100-200. But if I hide the refund transaction. I will need an additional reconciliation between the credit card statement from the bank and Concur?

Thanks

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@KenChan Why would you hide the refund transaction?

One thing that trips people up on expense reports refunds. The easiest way to explain them is to treat them like any other transaction. Add it to your report and submit it. This will even things out because if an overcharge or incorrect charge happened. SAP Concur doesn't connect to the user's card statement, so there is no way of seeing in SAP Concur the balance on a user's company credit card.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Thanks @KevinD . That's exactly what I was trying to say ...

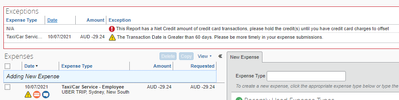

There is an exception NEGCCRPT (This Report has a Net Credit amount of credit card transactions, please hold the credit(s) until you have credit card charges to offset)

It is exception level 99. I am lowering it so that it won't be a hard error. I will see if the report will flow into our custom extract and our own accounting system properly.

Thanks

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@KevinDor @KenChan - could either one of you tell me what the exception NEGEERPT stands for? I stumbled upon another community post that references temporarily deactivating audit rules with the exception code NEGEERPT or NEGCCRPT to be able to submit a negative report. From what @KenChan has posted above, it would appear that the wording that goes with code NEGCCRPT is "This Report has a Net Credit amount of credit card transactions, please hold the credit(s) until you have credit card charges to offset".

I would like to add this type of audit rule, block to submit negative expense reports, to our Concur site but I can't see either of these exception codes in my Standard version so I'm assuming they are from the Professional version. Unfortunately I can't find another place in the community that describes these codes besides these two posts and I was hoping to implement either one or both of them when I have a better understanding of what the difference is between the two.

@KevinD- would you be able to tell me if the wording that @KenChan provided for exception code NEGCCRPT is Concur's out of the box wording or if his company has maybe made edits to fit their needs? I'm assuming one of these exception codes belongs to the yellow highlighted section as it seems like canned Concur wording.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@RobinN the audit rule and exception for negative amount expense reports isn't an out of the box rule for Standard. I believe you can create it though. The wording that @KenChan mentioned is the out of the box wording in Professional.

The nice thing for you is that you can make the wording anything you want it to be.

If you need help creating the rule, let me know.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Thank you for confirming that my version (Standard) doesn't have these out of the box - which is kind of crazy if you think about it. Either version can create negative reports, which aren't handled easily if you have Expense Pay, so it doesn't really make sense to not easily have this available in both versions. I do appreciate the confirmation of the Professional version's wording on NEGCCRPT.

Yes, I do know that in creating these audit rules, I can make the wording anything that I would like it to be but if it had come out of the box in Standard, I would have just left it at what it was. Since that isn't an option with Standard but it is for Professional, I figured it was easier to copy/paste than come up with my own wording.

@KevinD I think I can handle creating the rule based on going through some of the dropdown options as well as other community posts but I would still like to understand what the exception code NEGEERPT has as wording in the Professional version.

Also, I'm not sure if you could tell me what exception codes are behind the 2 blocked report alerts that were in the screen shot I provided from @shobhaRBC's post. Maybe one of them does belong to NEGEERPT?

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@RobinN here is the wording for each exception:

NEGEERPT: This report has a Net Credit amount due employee, please hold the credit(s) until you have out of pocket entries to offset.

This one is for out of pocket expenses.

NEGCCRPT: This Report has a Net Credit amount of credit card transactions, please hold the credit(s) until you have credit card charges to offset.

This one is for company card transactions.

My guess is the screenshot you provided is for the NEGCCRPT exception since the item shown is a company card transaction.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@KevinDAny thoughts on if a report has both out of pocket and company card transactions on it and it's still negative? Would implementing both of these audit rules catch it one way or another or do I need something completely different?

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@RobinN I don't believe that would matter as the one rule says Net Credit Amount due Employee (that is the out of pocket expenses) and the other says Net Credit Amount of card transactions. The system should see these as two separate amounts and evaluate each individually.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.