- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Re: Personal Charges on a Corporate Credit Card

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Personal Charges on a Corporate Credit Card

Hello,

Would anyone like to share how their company handles charges in personal nature when the employee uses the corporate credit card to pay for them? Logistically, how does your company obtain that money back from the employee? What disciplinary action, if any, do you take?

Thanks!

- Labels:

-

Best Practices

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@stephanierenner Hi Stephanie! Hopefully others will post their set up for this, but here is some info on how it can be done:

Each company may have different guidelines or specific payment processes for how employees need to repay for their personal expenses made on corporate credit cards.

- For your company guidance on how to pay for personal expenses, check your company's internal policy. Where can I find my company's Expense policy information?

- To check how much you owe and to whom you need to pay it for, follow the instructions below:

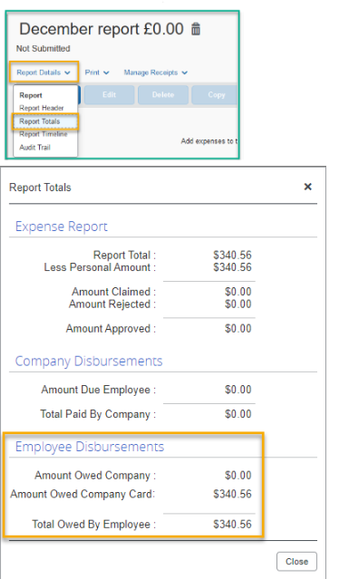

After submitting your report, check under Report Details > Report Totals to find total amount owed:

- Depending on your User Interface Employee Disbursements may be shown as Total Owed by Employee instead

- Some companies may require that employees make reimbursement for personal expenses on corporate card, to their company directly, and not to their credit card provider.

- If payment needs to be made to credit card provider, contact your credit card provider to verify the payment process

- If reimbursement needs to go to your company, check what your company's defined process to repay is made available or create a Support ticket.

You can either have the user write a check to your company for what they owe, deduct from their paycheck, or not allow them to submit personal charges unless they have Out of Pocket expenses that would make up the amount owed.

I hope this is helpful, let us know if you have more questions!

Remember to tag me if you respond or feel free to mark this post as Solved if you don't have further questions or comments. To tag me on your response, you click the Reply button, first thing to type is @. This should bring up the username of the person you are replying to.

Thank you,

Melanie Taufen

SAP Concur Community Moderator

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Does Concur have setup steps or a guide for how to set it up where personal expenses owed by the employee to the company can be deducted from Payroll?

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@MelanieT thank you for that very detailed reply. Our current policy doesn't address the way the employee needs to reimburse the company so I'm hoping to get some ideas on how other companies do it. I like the idea of payroll deductions, but just wondering, logistically, how you get the approval from the employee to make the deduction and how you relay the information to payroll. Looking for efficiencies!

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

We started with having the employee send a check or money order to us for any personal expenses. (We do have the carry forward turned on, but rarely do employees have cash expenses to cover the personal balance owed.)

We just recently got payroll on board to allow an excel file with paycheck deductions to be sent to them from my team. These are only for employees that have approved the deduction though, so it is still a manual process to communicate the balance and get the approval to deduct. The employee balance is then cleared from Concur once the report is sent to Payroll. This is better than the paper checks but still not an automated process.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Sounds good! You might want to reach out to your HR or Payroll group as they might be able to answer that too! 🙂

Remember to tag me if you respond or feel free to mark this post as Solved if you don't have further questions or comments. To tag me on your response, you click the Reply button, first thing to type is @. This should bring up the username of the person you are replying to.

Thank you,

Melanie Taufen

SAP Concur Community Moderator

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@MelanieT is there a way that amount marked as personal do not reimburse can be recorded as a credit on the user profile so that the next time said employee has a claim for reimbursement it will be auto deducted.