- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Re: Meals - General Ledger Requires 2 Account Code...

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Meals - General Ledger Requires 2 Account Codes

We need to split our meals categories between 2 different GL codes, 50% to taxable and 50% to non-taxable. This is a requirement for Canada and the US when doing tax reporting and I'm thinking there must be a way to do this but I was told there is not. Currently, we are exporting our GL and then manually reclassing.

- Labels:

-

Best Practices

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@mhazlitt Hi! You definitely can have a hierarchy set up for your ledger. This would need to be set up on our side, and then you would then populate the Account Codes once the ledger is set up. I am attaching a Tech doc for you and it explains how you can have it set up and also has screenshots for you too! Let us know if you have more questions once you look at the document.

Remember to tag me if you respond or feel free to mark this post as Solved if you don't have further questions or comments. To tag me on your response, you click the Reply button, first thing to type is @. This should bring up the username of the person you are replying to.

Thank you,

Melanie Taufen

SAP Concur Community Moderator

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@mhazlitt hello there. I just spoke to someone to get a second opinion on what you asked. I'm not sure who told you this cannot be done, but I'm here to say it can be done.

You can use the itemization option to do this. You would need to set up a meal expense type for when the meal is taxable and another when it is not. For example: Breakfast - Taxable as one expense type and then simply Breakfast. You could repeat those expense types for all meals. Then you would need two more expense types; 50% Taxable and 50% Non-taxable. The user would then itemize those meals that fall under taxable by using these two expense types. Since each expense type in the system is required to have a GL Code, you would then have taxable meals split between two GL codes when the users itemize. I'm providing some generic examples of expense types, but I think it gives you a good idea.

Lastly, to ensure employees are doing this, you can build an audit rule that will require the taxable meal expenses to be itemized.

I hope this helps.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@mhazlitt We have 3 GLs for meals/entertainment and 6 expense types. One GL for 0% nondeductible, 50% deductible, and 100% deductible. In Concur, I have assigned to each of the 6 expense types the GL that reflects how we need to account for it for tax purposes. We are able to review the data from Concur on a level of the 6 different expense types, and then on the GL only see the 3 accounts for tax purposes. Its been working besides occasionally needing to adjust the Expense Type selected, but this is mainly due to the end user maybe not being fully aware of the parameters we need for tax filing.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

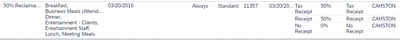

Hello under Company Administrator , Tax Administration we have Tax & Reclaim Groups set up for each province with the Reclaim percentage. For the expense types

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

I have it set up on the GL side of things. Our outside auditing firm likes this. One GL #83100 is for Meals and Entertainment. This is where all meals (not education meals) should go. Our CPA's know this is the 50% M&E. One GL #85100 is for gifts and ticketed events - this is the 100% non deductible. and then #84100 is all other business development and is 100% deductible.