- Home

- :

- Product Forums

- :

- Concur Expense

- :

- Re: I need help with my expense report for apartme...

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

I need help with my expense report for apartment rent report expense number: 2126532

Hi to all.

I need help with my expense report for Apartment rental. I have two expenses on my Company Credit Card. First expense was reservation of Apartment, the second expense is additional expense for Apartment rental while check-in. Now when I want to do a report and submit it I need to enter room rates and room taxes which are not the same. This is seen on receipt which is attached to expense report. But when I do the Itemizations form first expense I get the correct sum up of both expenses + second expense is added up. I cannot also match this two expenses.

I am really lost here. Can anyone take a look and help me with this expense report.

Thanks in advance for Your help,

Best regards,

Mihael Buganik

Solved! Go to Solution.

- Labels:

-

Help

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

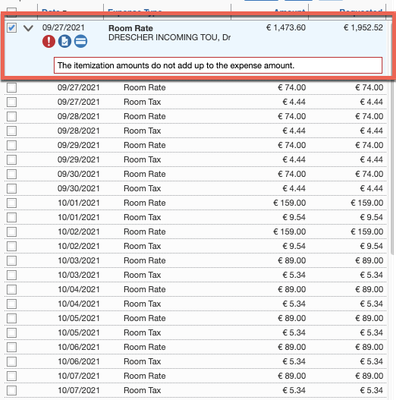

@Mihael1987 I'll see if I can explain what you need to do without confusing you. 🙂 I looked at your report. The receipt shows all of the charges for the apartment stay which adds up to 1952.52. However, 478.92 of that total was charged separately like a deposit. In your itemizations, you included all the charges (which includes the 478.92), that is why you are over by 478.92. So, for your first expense entry (see first screenshot) you will need to adjust the amounts of some of the itemizations by reducing them until you have accounted for 478.92. Not sure if you know, but the individual itemization amounts can be changed. What I would suggest is to take each itemization that is listed as Room Rate (there are 17 of them) and reduce each by 28 Euros. This will account for 476 of the 478.92. Then take one of the Room Tax itemizations (I would do the first Room Tax listed which is 4.44) and change it to 1.52EUR. That should then get your total for the itemizations to 1473.60 which matches the amount charged to your corporate card. You might have to check my match, but I think I got it. The point is that you can adjust the amounts of the itemizations to whatever you need so your amounts match up.

Be sure to use the Comment field for this expense to explain why you reduced the amount of some of the itemizations.

Now, for the second expense (see screenshot) you can treat this as a one night stay. When you go to itemize the expense, you will see that the Check-out date shows as 9/27/2021. Leave that as is and put in the Number of nights field a 1. For the Room Rate, enter 478.92. Basically you are lumping the pre-payment into one single night. Click Save and that should do it.

Give all this a try and let me know if it worked.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Mihael1987 I'll see if I can explain what you need to do without confusing you. 🙂 I looked at your report. The receipt shows all of the charges for the apartment stay which adds up to 1952.52. However, 478.92 of that total was charged separately like a deposit. In your itemizations, you included all the charges (which includes the 478.92), that is why you are over by 478.92. So, for your first expense entry (see first screenshot) you will need to adjust the amounts of some of the itemizations by reducing them until you have accounted for 478.92. Not sure if you know, but the individual itemization amounts can be changed. What I would suggest is to take each itemization that is listed as Room Rate (there are 17 of them) and reduce each by 28 Euros. This will account for 476 of the 478.92. Then take one of the Room Tax itemizations (I would do the first Room Tax listed which is 4.44) and change it to 1.52EUR. That should then get your total for the itemizations to 1473.60 which matches the amount charged to your corporate card. You might have to check my match, but I think I got it. The point is that you can adjust the amounts of the itemizations to whatever you need so your amounts match up.

Be sure to use the Comment field for this expense to explain why you reduced the amount of some of the itemizations.

Now, for the second expense (see screenshot) you can treat this as a one night stay. When you go to itemize the expense, you will see that the Check-out date shows as 9/27/2021. Leave that as is and put in the Number of nights field a 1. For the Room Rate, enter 478.92. Basically you are lumping the pre-payment into one single night. Click Save and that should do it.

Give all this a try and let me know if it worked.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Dear @KevinD ,

Thank You very much for Your quick response with mentioned issue with concur report. The issue is solved. This was a good solution. Everything is OK and I could submit expense report.

Best regards,

Mihael Buganik

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Wouldn't it have been easier to add an Itemization line item of -478.92 and comment it was a deposit charged separately. Then the deposit charge would be marked as the deposit and easily identifiable when auditing.

Agfa

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Nancyagfa It would have been faster, definitely. Not sure why I didn't think of that.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.