- Home

- :

- Forums

- :

- Concur Expense

- :

- Expense report in Concur for Cash advance on Compa...

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Expense report in Concur for Cash advance on Company Card

Any sample expense reports are available for expense reports for ATM CASH ON COMPANY CARD

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@VINAYA are you asking to see an example of an expense report that has ATM Cash On Company Card?

Thank you,

Kevin Dorsey

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@VINAYA Hello! I do not have an example report per se, but I do have this:

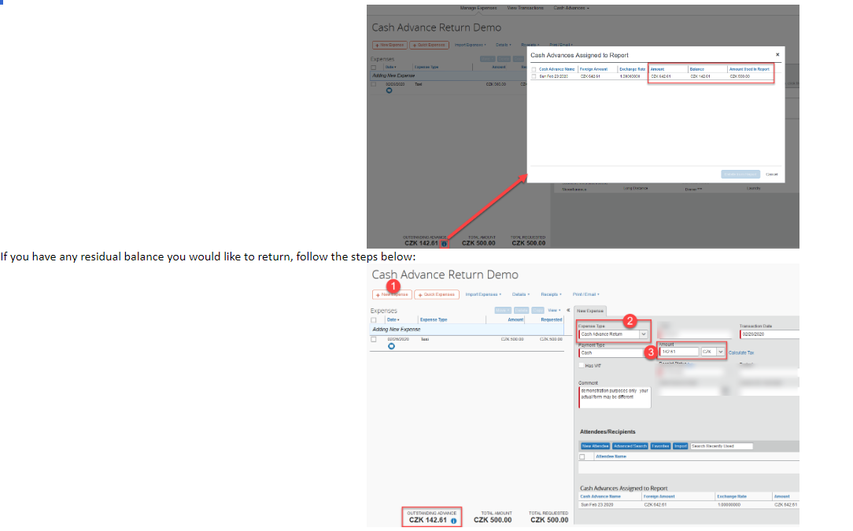

As per your company’s current cash advance and corporate card settings, ATM withdrawals are imported in Concur as Cash Advances. In order to match these withdrawals against incurred travel expenses, these cash advances have to be assigned to your expense reports. Once assigned to a report, any cash expenses added to that report will be automatically deducted from its outstanding balance. Any residual balance can also be accounted for by adding the expense type “Cash Advance Return”.

You can find below a demonstration of how to assign and return ATM cash advances:

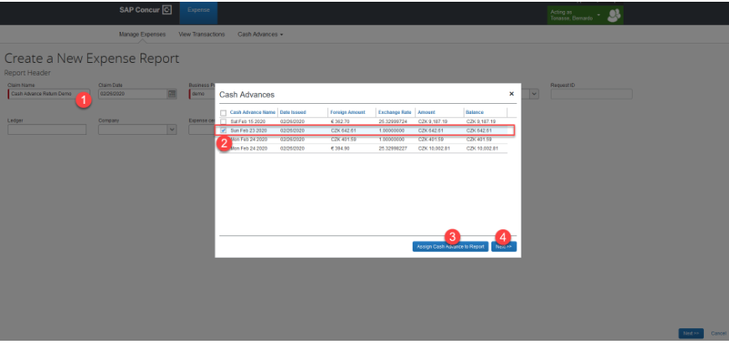

- Create a new report, fill out the required fields and click Next.

- If you have outstanding ATM cash advances, you will be prompted to assign one to your report

- Select the cash advance(s) you want to assign to the report and click Assign Cash Advance to Report.

- Click Next.

|

As per your company’s current cash advance and corporate card settings, ATM withdrawals are imported in Concur as Cash Advances. In order to match these withdrawals against incurred travel expenses, these cash advances have to be assigned to your expense reports. Once assigned to a report, any cash expenses added to that report will be automatically deducted from its outstanding balance. Any residual balance can also be accounted for by adding the expense type “Cash Advance Return”.

You can find below a demonstration of how to assign and return ATM cash advances:

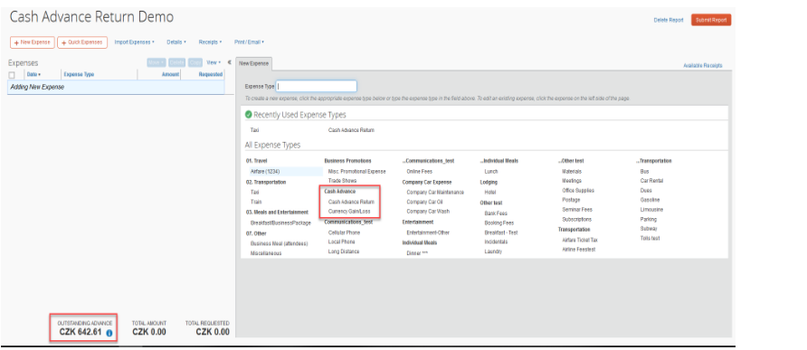

Now, when you open the report, you should see your outstanding cash advance balance (see image below), and you should be able to select the Cash Advance Return expense type.

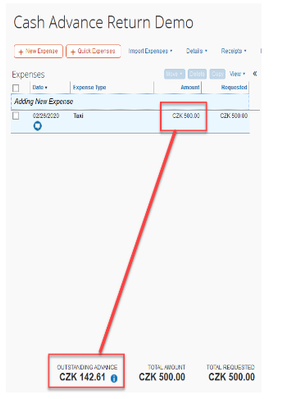

When adding Cash expenses (not Corporate Card expenses) to a report to which a cash advance has been assigned, the amount will be automatically deducted from your outstanding balance, as in the example below:

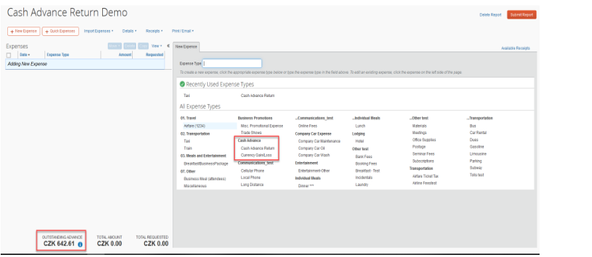

You can click on the blue icon next to your Outstanding Advance to display more information about cash advances assigned to the report, which can then be unassigned from the report. See image below:

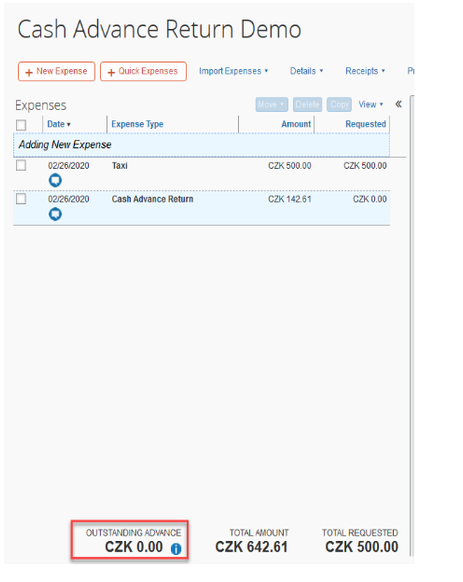

Notice your Cash Advance Return has been deducted from your Outstanding Advance (see image below):

|

Remember to tag me if you respond or feel free to mark this post as Solved if you don't have further questions or comments. To tag me on your response, you click the Reply button, first thing to type is @. This should bring up the username of the person you are replying to.

Thank you,

Melanie Taufen

SAP Concur Community Moderator

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.