- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Re: Audit Rule for Meal Limits and Credit Cards

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Audit Rule for Meal Limits and Credit Cards

I want to create an audit rule that stops people claiming over an amount for a meal. If this is a cash claim then I can do this easily, but if its a company credit card then I still need the full amount of the meal accounted for. I've been looking at using itemisation and having the amount over the limit marked as personal but I can't get this to work.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@nyates Hello! Are you saying that if it's a cash transaction they can only claim so much, but if it is a CC transaction, they can expense the whole amount? Just want to make sure I am understanding what you need.

Remember to tag me if you respond or feel free to mark this post as Solved if you don't have further questions or comments. To tag me on your response, you click the Reply button, first thing to type is @. This should bring up the username of the person you are replying to.

Thank you,

Melanie Taufen

SAP Concur Community Moderator

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@MelanieT Hi Melanie, I want to put a limit on the Card claims but the employee still needs to account for the entire spend as the cards are company paid. eg, if someone uses a card and spends £20 on lunch and the limit is £15, I want to be able to limit their claim to £15 whilst still account for the full £20. I am thinking of doing this by using audit rules to force £5 to me marked as Personal spend.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@nyates you should be able to create a rule that says if the entry is a card transaction AND the Expense Type Equals Lunch AND The Entry Amount is Greater than 15GPB AND the Transaction Type Equals Expense without itemization. This should prevent any report where someone went over the limit from submitting unless they itemize. There may be a little more to it as well. Stay tuned.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Thanks Kevin - the Transaction Type suggestion is really helpful. So my next problem is this....I have an entry of £20 which I should itemise as £15 lunch and £5 personal. But how to I force the £5 to be personal as it is below the limit? If I itemise as £15 and £5 and do not mark as personal it will still pass the audit rule.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

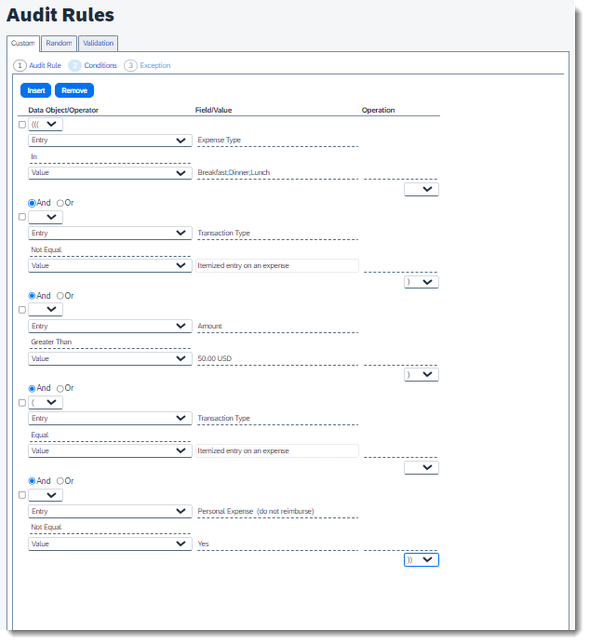

@nyates try building your rule like the below. My colleague sent this to me. Give it a test and let me know if it works or not.

For the first condition, don't use the "In" operator. Use Equals, then the one expense type you want. I think you might need to make one rule per each meal. It's really easy because you create the one rule, get it all set up, then make a copy. Once copied then just edit the expense type and the amount.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.