- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Airbnb, Expedia, or lodging stays without a typica...

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Airbnb, Expedia, or lodging stays without a typical itemized receipt

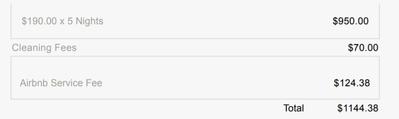

Using Concur expense standard platform. We allow employees to book lodging through Airbnb, Expedia or other 3rd parties. What guidelines do you give for the itemizations? I am advising separate out the tax amount from the base rate only if the receipt specifically states "tax". If it is a cleaning fee or service charge, it should be included in the nightly rate. We do not use Concur for tax reporting but we do need the base nightly rate to conform to the policy. I am seeing users enter the service and cleaning fees as "tax". They are quite high, sometimes as much as 25% of the base rate. How do you advise users on these itemizations? Here is an example receipt.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

One solution would be to add an expense type for cleaning/service fees for hotels. I would want to be able to report on that seperately from the room rate.

Our issue with Expedia is that the traveler doesn't have any information that breaks out hotel vs air or tells them any details. Our employees are not supposed to use Expedia but sometimes they do.

T-Mobile

Senior Analyst Travel, Card & Expense

US

https://www.linkedin.com/in/sandra-ahola-4704553/

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hello, EATON travel policy explains that is not allowed to use Airbnb, however i can see several post where they stated that they have used it. does the policy has changed?