- Home

- :

- Product Forums

- :

- Concur Expense

- :

- 2023 IRS MILEAGE RATES

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

2023 IRS MILEAGE RATES

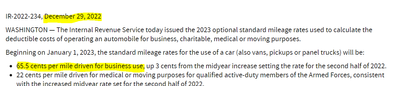

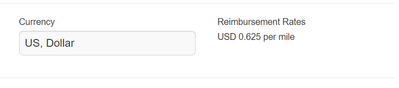

Why hasn't the Mileage Rate been updated from 62.5 cents/mile to the new IRS requirements of 65.5 cents/mile? January is almost over and it still reflects 2022 Rates.

- Labels:

-

Reporting

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@dkcoates as far as I know, unless something has changed, the system does not automatically update mileage rates.

I'm sure you might be wondering why...because not all companies use the IRS Rate. If it automatically updated, there would be a lot of users submitting the wrong reimbursement amounts, which would cause a lot of issues for Finance departments.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Kevin is correct, the rates don't automatically update. Your company Concur Admin should be able to update those rates in Expense Admin - Car Configuration. The notice by the IRS was late this year, December 29 was much later than usual for their decision!

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

That is correct. The administrator must update the rates in Expense Admin. I learned the hard way last year, since I was new to this role. I had to adjusting journal entry for those who were paid incorrectly, manually.