- Home

- :

- Resources

- :

- Admin Resources

- :

- Maximize Your Solutions

- :

- How Corporate Card Programs Help Companies Reach E...

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

How Corporate Card Programs Help Companies Reach Employee Spend Goals

Over the years of working with hundreds of clients I have come across a wide variety of perspectives regarding the deployment and use of corporate cards.

When I have spoken to a prospective customer who is opposed to the use of corporate cards I find it is often in reaction to a poor experience with an individual who has defrauded the organization by putting personal items on the card and not paying for them. While it is valid to be skeptical of cards following this kind of experience, it is also important to put it in a broader context. One bad apple does not mean that all the other apples have spoiled.

I’ve also come across companies where all major expenses go on the CEO’s personal black card so that he or she could accrue the personal benefits from this prestige card. This isn’t something I would recommend.

Here’s why I think most, if not all, organizations should use a corporate card.

Card Programs

While we’re on the topic of what we call these cards, there is also sometimes confusion about what we call these cards based on what different companies call them. For the purposes of this post, here’s how I categorize these forms of payment.

- Corporate Card. Physical, plastic cards issued to individual cardholders with those individual’s names on the cards. Sometimes called Travel Cards. Some organizations such as Higher Ed institutions prefer to refer to them as University Cards or purchasing cards.

- Purchasing Card, Procurement Card or P-Card. Usually physical, plastic cards used in place of other procurement processes such as Purchase Orders and Invoices. Used for smaller purchases such as office supplies or items that are not in a company’s procurement program or catalog. Often issued to a small group of individuals, sometimes one individual within each department. Usually limited by Merchant Category Code (MCC) such that they cannot be used to procure travel, i.e., the card will be declined if presented to an airline, car rental agency or hotel. This is the card program that causes confusion as some firms refer to their Corporate Card as a P-Card. In many cases, a company has both Corporate Card and Purchasing Card programs.

- Meeting cards. A subset of Purchasing Cards. Usually used by meeting professionals who may be booking tens or hundreds of thousand dollars of spend at a time on hotels, catering, meeting rooms, banquets, conference centers, trade show suppliers, etc.

- Lodge card or Ghost card. Sometimes called a Corporate Travel Account (CTA). American Express calls theirs a Business Travel Account (BTA). Usually not physical plastic. This “card” has a number identical in length to a Visa/MC or AMEX card. It is lodged, or on file, with a Travel Management Company (TMC) and is used to pay for airfare, and sometimes rental cars and hotels.

- Virtual Cards. A newer form of payment that may serve the same purpose as a Lodge card. A one-time use card number is generated by computer systems at the time of payment. Good for infrequent travelers, guest travelers and the like.

This list is no where near exhaustive. We haven’t covered Diversion accounts, Fleet Cards, or Fuel Cards. Card providers are always looking to innovate in payment programs to serve customers and to gain competitive advantage.

Now that we have that out of the way… why use corporate cards?

Savings and Rebates

Most card issuers provide rebates to the company based on spend volumes and on-time payment record. Depending upon your spend volume, these rebates can add up to enough to fund a full-time employee (FTE) or several FTE’s. There’s room for an entire discussion on card billing types (Corporate or Individual Bill (CB or IB), and Corporate or Individual Pay (CP or CP). Each have their merits and drawbacks. For example, CB/CP programs tend to offer the largest rebates. I have a colleague who managed the T&E process for a large pharmaceutical company that had a CB/CP program. The rebates were so substantial that they easily outweighed the time spent persuading employees to submit expense reports in a timely fashion and the cost of the rare fraud.

Another client, a motion picture company, drove 80% corporate card adoption (as a percentage of spend) resulting in a reduction in overall T&E spend of $1.2m, while increasing card program rebates by over $80,000.

In addition, as will be detailed in the following sections, corporate cards tend to be easier to reconcile, which reduces the number of Accounting resources need to manage the T&E process.

Improving the amount of data available to procurement teams can lead to stronger negotiating positions and better supplier discounts.

Streamlined Processes

A steady flow of card charges into the automated expense reporting system gives Accounting staff earlier visibility into spend that hasn’t been submitted on an expense report yet. It helps with accruals and managing cash flow.

Data attached to corporate card imports contains Merchant Category Codes (MCC), which can be automatically linked to Expense Types in an automated expense reporting system. For example, card charges with British Airways MCC of 3005, can automatically be tied to an airfare Expense Type. Rather than relying on employees to enter these, the system does it for them with higher levels of accuracy.

Reimbursement processes can be automated, too. Payments can be automatically set up to flow to corporate card providers for approved expenses.

Enhanced controls

Access to more and better data leads to better compliance with policies and procedures. And, corporate card programs yield more data than cash out of pocket expenses entered by hand, or even those imported from a personal card program, which tends to have little more than a merchant name, date and amount.

Unfortunately, expense report fraud is something every Accounting department has to consider. While I’ve had people tell me they feel fraud is more likely to occur with corporate cards, the truth is just the opposite. Corporate cards provide better controls and help control fraud.

Let’s consider some common examples of fraud schemes with personal cards. An employee buys office supplies, perhaps even a printer, from an office supply store. He or she requests a duplicate receipt or submits a photocopy or picture of the receipt. Then, the employee returns the items for a refund.

Another common scam is the purchase of a refundable airline ticket on a personal card. Some companies that do not require the use of corporate cards require submission of a boarding passes to prevent this scam.

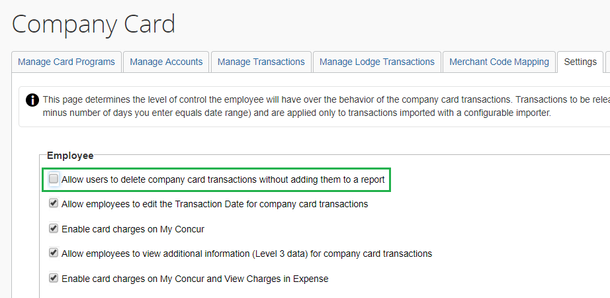

Corporate cards do the trick without requiring paper submissions. By not allowing employees to delete company card transactions, any returns or exchanges from purchases made on the card would be visible to the back office.

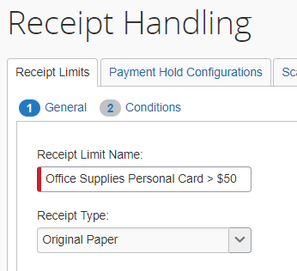

And, if the employee continues to avoid using his or her corporate card for these kinds of expenses, a Receipt Handling rule requiring original paper (receipt, boarding pass, etc.) will do the trick.

Finally, Artificial Intelligence and Machine learning services like Concur Detect make it even easier to improve business controls around T&E.

Ease of Use and End User Satisfaction

With a good automated expense reporting system like Concur Expense, there’s a lot less manual work involved in reconciling and submitting expenses when using a corporate card program. Card charges are imported and categorized automatically each night. As many companies require receipts for corporate card charges over $75, and non- corporate card charges over $25, there are fewer receipts to keep up with.

Cardholders tend to submit expense reports more quickly and get faster reimbursements for the out-of-pocket portion of their expense reports.

And, cardholders do not have to carry company costs on their personal card, which can be financially burdensome.

Of course, some end-users want to use their personal cards to get the points or cash rebates that accrue from the spend. And some companies are okay with this, which surprises me. I don’t know of any companies that let employees keep the discount on a 2/10 net 30 invoice.

Enhanced Data Management

Using a corporate card program means a company gets more detailed data about its spend. Merchants may transmit Level 2 or Level 3 data, which may include Merchant Category Code (MCC), sales tax information, item commodity codes, descriptions, quantities and more.

Concur also refers to this as Rich Data as Level 3 is not a term used by all participants in the card industry.

Conclusion

There is a school of thought that says there are three legs to a well-managed T&E program:

- Automated Expense Reporting

- Managed travel program with a Travel Management Company

- Corporate payment card program.

While every organization’s T&E priorities are different, the savings, process improvements, enhanced controls, and increased access to data that a corporate card program provide can usually help achieve organizational goals around employee spend.