- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Setting tax conditions

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Setting tax conditions

Are we able to set up our own VAT groups and give it more than one Tax Condition

Solved! Go to Solution.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Samfarrell Hello there. I looked at your site and you are on our Standard/Best Practice platform which does not allow for creating your own Tax Groups and conditions. You will use the current standard VAT rates of the UK and any other country you have activated in your site.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

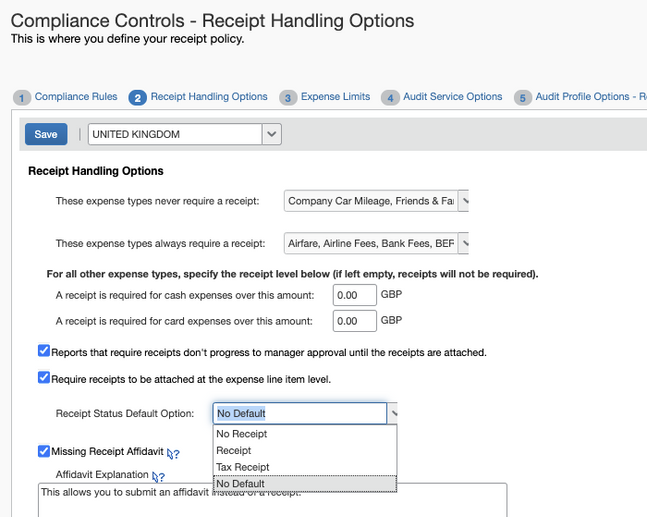

@Samfarrell thank you for clarifying. There is an option for No Receipt, Receipt and I think Tax Receipt. This field will show automatically on every expense entry the user creates. You can set the default for this field or select it as No Default. I've provided a screenshot for you.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi. Our company generally only has domestic expenses, but Canada has many tax exempt and zero rated items, as well. We set up our expense types to reflect this issue. For example, tolls, the expense type was set up as a no tax expense. Other expenses types may or may not have tax so when there could be such an occurrence, we set up two expense types. Example: Training (with GST/HST) and Training (no GST/HST) and ask the submitter to choose appropriately.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Samfarrell Hello there. I looked at your site and you are on our Standard/Best Practice platform which does not allow for creating your own Tax Groups and conditions. You will use the current standard VAT rates of the UK and any other country you have activated in your site.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Thank you for your prompt reply so to clarify, I have berthing fees under tax rate Exempt/Zero – 0% with a reclaim condition of ‘No receipt’ that is fine but are you saying that if I wanted to add a reclaim condition of say ‘receipt’ I can’t?

If an employee was entering an expense for berthing fees the only drop down option to them would currently be ‘no receipt’?

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Samfarrell thank you for clarifying. There is an option for No Receipt, Receipt and I think Tax Receipt. This field will show automatically on every expense entry the user creates. You can set the default for this field or select it as No Default. I've provided a screenshot for you.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi. Our company generally only has domestic expenses, but Canada has many tax exempt and zero rated items, as well. We set up our expense types to reflect this issue. For example, tolls, the expense type was set up as a no tax expense. Other expenses types may or may not have tax so when there could be such an occurrence, we set up two expense types. Example: Training (with GST/HST) and Training (no GST/HST) and ask the submitter to choose appropriately.