- Home

- :

- Product Forums

- :

- Concur Expense

- :

- Personal Car Milage Calculation

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

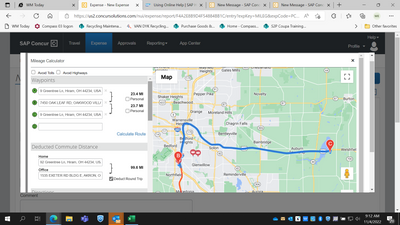

Personal Car Milage Calculation

I have an employee that drives to a new temporary location. They are due milage for the difference between old and new location how can I calculated this correctly? Example:

Home to old location 50 miles roundtrip

Home to new location 100 miles roundtrip

Difference of 50 miles per day.

I used, however when I used the deduction option, miles are zero difference. Is this the correct process?

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@mevans7 the details provided in the screenshot show me that this user would not be owed any month since the calculated distance is only about half of the deducted commute. If their commute is longer than the distance they drove, they won't be allowed any reimbursement because they actually drove less than they normally would if they were commuting.

I wouldn't use the Deduct Commute option if they are to be owed reimbursement for 50 miles of driving. I think if you uncheck the Deduct Commute and leave the distance calculated in Waypoints A, B, and C, you would be good to go.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.