- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Non-deductible taxes: No tax processing &Tax repor...

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Non-deductible taxes: No tax processing &Tax reporting only Spain

Hello,

I've a problem with posting some expenses from concur to SAP. This expenses have a Tax rate 0% - 3I and 4% - N1.

First case - 3I- 0% - tax should be ignored .

Second case - N1 - the non-deductible tax is not shown in the posting but the tax information shows

the non-deductible VAT.

The country is Spain and we use a BADI SPLIT Document: BADI_CTE_FIN_POST_ADJUST_DOC -> IF_BADI_CTE_FIN_POST_ADJ_DOC~SPLIT_POSTING_DOCUMENT

We don't have any problem if the Tax is >0 and BADI has to create a line with TAX. The problem appear when the tax rate is 0% and BADI does't have to create a line with TAX.

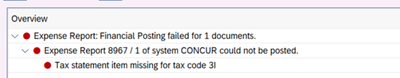

The message we receive is "TAx statement item missing for tax code 3I"

We think this happens because when we receive a data from Concur we have a value in the Tables : ACD_TAX and ACC_TAX_BUZEI. We don't understand why we receive this data if tax is 0% and SAP doest need to create a VAT line.

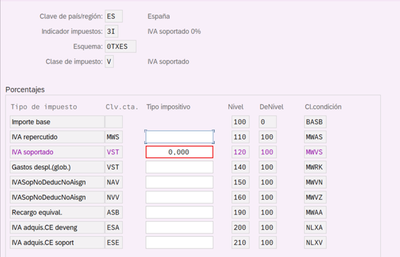

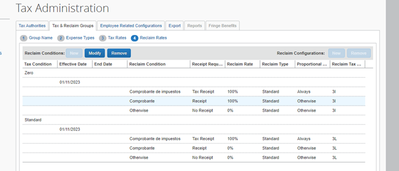

The TAx configuration is correct:

And Concur configuration we think also is correct:

We have another client they have the same configuration as we have, the only difference is that they have SAP R3 and we have SAP HANA . we have same Tax configuration and we have same Concur Tax configuration and when they receive expenses from concur with VAT 0% this tables ACD_TAX and ACC_TAX_BUZEI doesn't contain any data.

We didnt find any explanation or configuration in SAP Integration - Tax Configuration Solutions . We would like to know if anybody had the same problem we have or maybe there are some Concur experts who can explain to us how we can solve this problem .

thank you

- Labels:

-

Configuration

-

How To

-

Integrations

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Kat_kos01 your question is quite technical so you likely will not receive a response in this forum since it is more read by end users and not those who would deal with your issue.

I suggest requesting to join the Admin Group here on the community and posting there. A couple of things to note about being admitted to the admin group:

1. We will need your work email address. I see you have a gmail address listed on your profile. The reason for this is I will not be able to find your SAP Concur profile without your work email.

2. You must have site admin permissions in your site. We do verify your site permissions prior to admitting you to the group.

Let me know if you have any questions.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.