- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Re: Location populating from Amex - even though un...

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Location populating from Amex - even though unchecked

We have our configuration set not to populate the location from Amex since we are in Canada and pre-population creates issues when the head office location feeds in. In spite of the checkbox for this being correctly set to unchecked, the location is still pre-populating the province. Issue appeared when we moved to Next Gen UI. Anyone else in Canada experiencing this issue ? Employees do not tend to review this field and change so this is impacting tax calculations. We want them to have to enter the location themselves. Otherwise, certain vendors pre-populate with the head office locations (e.g. Imperial Oil feeds in as New Brunswick, Air Canada feeds in as Manitoba, Westjet feeds in as Alberta, etc.)

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Dale_Lee so forgive me for asking a question that might seem like an obvious questions, but since we don't have different province taxes and GSTs, HSTs, etc. I have to ask.

If I live in let's say Vancouver, B.C. and I do purchase airfare on Air Canada and their HQ is in Manitoba, isn't that purchase considered in Manitoba? I'm comparing it to me purchasing something from California, but I live in Arizona. I will be paying California sales tax, because that's where the company is located.

Also, could you provide a screenshot of the screen where you unchecked the location checkbox? It was in SAP Concur, correct?

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

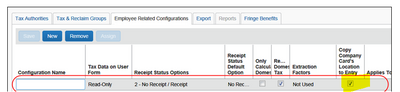

Hi Kevin, tax for airfare is based on the departure location. So if I live in B.C., and am departing from B.C., it should be based on B.C. tax rates, not Manitoba. Easier to explain with other expense types, example I am in B.C. and fill up my vehicle at gas station there. The tax is based on the location, which is B.C., so it presents a problem when the Amex charge feeds in with the head office location in New Brunswick. Configuration in Concur allows the location in Amex to be suppressed, thereby forcing the use to verify and enter the location. This is outlined in Concur's Vat configuration guide. The checkbox in our configuration is cleared, so the location should not populate.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Dale_Lee thank you for the explanation and the screenshots. I didn't know this was an option in the Tax configuration. It's nice to have someone teach me something. :-).

Do you by chance have any card transactions in your profile that I could look at on an expense report? If not, send me a private message with someone who does. I just want to take a look to see what is happening. I may be able to ask around too.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Thanks, Kevin. I don't but can see if I can find someone who does. I'll message you. Note that we DO have a ticket opened on this - I'll also see if I can find out the ticket number (these aren't opened by me). Really I was wondering if this was a "known issue" and if anyone else was experiencing it.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

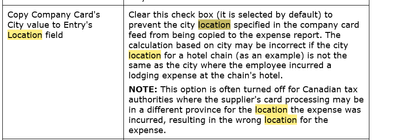

Also, I don't have visibility to our configuration but a ticket was opened and Concur confirmed that the location box in the configuration was in fact, UNchecked. So the location should not be populating but it is. See the checkbox from documentation here:

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi

This is problematic for us, as well. We have a few steps to mitigate:

- We set up an audit rule, as a general informational, that pops up when a report is first created reminding cardholders to review and possibly change city fields, appropriately. We provide an example in the informational for clarification. Think of a bell curve, this works for the top half of the curve.

- our back end processors are alert to this problem and are able to change the city themselves before approving the report.

- for submitters who frequently make purchases and payments, back end processors send an email template about this subject to the submitter reminding them about the required changes for future submissions; next time email is escalated to include their approver, third time their reports are sent back. By having an escalation process, we have better buy in for our program. Frequent users and approvers have become alert to this issue, veterans of the system are pretty good about it now. We give infrequent users a pass.