- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Re: Limts by Expense Category vs Expense Type

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Limts by Expense Category vs Expense Type

New to Concur so i wanted to quickly thank everyone in advance for this resource and their help. At our firm we have a daily limit on food at $100. We added all of the expense types (i.e. Breakfast, Lunch, Snack etc....) that would fit into this limit into a single expense category "Meals subject to $100 limit" Is there a way to set the limit by category? It seems like the only way i could do this would be to either make a limit on each specific expense type or lump all those expense types into one. Maybe i am going about this the wrong way, not sure. Any help would be much appreciated. Thanks Aryeh

- Labels:

-

Configuration

-

Help

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Aryeh2b You cannot set the limit by category and even if you could, I personally wouldn't suggest it since you may have expense types like Business Meal that could fall into this category if not changed by someone during configuration.

You can make a daily meal limit total that includes multiple expense types, so that you can include breakfast, lunch and dinner and have the audit rule look at those three expenses and do an aggregate total on them to see if it goes over the daily limit.

Reminder: Always, test the audit rule with a test user before activating for your employees.

Let me know if you have any questions.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Kevin,

Thank you for the quick reply. I just spent 15 min looking through the system, where can i set up an Audit Rule?

Thanks

Aryeh

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Aryeh2b first thing I need to know is what type of configuration you are on. We have two, Standard and Professional. Accessing audit rules is a little different for each. To know what version you are on, from the Concur home screen, mouse over Administration in the upper right corner. You should see a little drop down menu appear. If you see an option that says Expense Settings, you are on Standard. If this is the case, Audit Rules are most likely not turned on and can only be turned on by Concur.

If you are on Professional, you have to have some sort of Admin permission, which I'm guessing you have.

I'll await your reply to see which version you are on.

P.S. Here is a resource for you to see how to create an audit rule. This will help you understand how it works.

Video Demo: https://assets.concur.com/concurtraining/cte/en-us/cte_en-us_exp_audit-rules.mp4

PDF Document Guide: http://www.concurtraining.com/customers/tech_pubs/Docs/_Current/SG_Exp/Exp_SG_Audit_Rules.pdf

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Yes i am on Standard. I reached out to my impementation rep to see if he can make it professional - not sure what is involved or if there is an additional charge.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Aryeh2b there is a charge for migrating your site to Professional, but in all honesty, to create an audit rule, you do not need to be on Professional. You just have to request to your implementation rep to have Audit Rules turned on. I'm not sure if there is a fee associated with that, but I'm guessing it will be a lot less than migrating your entire site. Also, migrating your site isn't just something that can be done over night.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Thanks for sharing, Kevin!

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Aryeh2b currently you cannot. Our Standard configuration does not have the custom audit rule option turned on. You'll need to ask your Concur implementation person about getting it activated.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Kevin,

I finally got access to audit, but was a bit lost. Would you be able to walk me through the steps needed to create a report that added several expense types together on the same day and capped it at $100. As dicussed above in lieu of capping breakfast, lunch and dinner individually we just give employees $100/day which would include breakfast lunch dinnner + snack.

The othe caveat is if 2 employees are travling together, assuming they list the attendee will the system know to only allocate half of the dinner expense cost towards the employees per diem cap?

Thank you again for your help

Aryeh

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Aryeh2b So, you were able to get access to Audit Rules, is that correct?

Also, for the $100 a day limit. Do you want to prevent submission of reports if the total is over this amount or just warn/remind users to not go over this amount? I ask because if you just want to warn/remind, you don't need an audit rule for that.

As far as employees traveling together...if they have a meal with both in attendance and one of the employees pays for the meal, this is a business meal/group meal and usually isn't counted in the $100 daily limit because it is isn't an individual meal and also most likely has a different account code to charge against in your accounting software. The user wouldn't categorize a meal with two people in attendance as Breakfast, Lunch or Dinner, but rather as Business Meal (attendees).

I'll await your reply about the block submission or warn. When you reply, be sure to tag me by using @KevinD. That way I can be informed when you reply.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@KevinD. We have a separate expense type called Business meals for whenever an employee has a meal with an outside party. Those meals are not part of the $100 cap. If the meal is just company employees who are traveling together and eating together then we list those as "Breakfast, Lunch or Dinner" and should be part of the cap.

I would like to prvent submission if they exceed the $100 cap in a given day.

Regards

Aryeh

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Aryeh2b So, I'm providing you links about audit rules. One is a little video demonstrating audit rules. The other is a guide on setting up audit rules. Give these a look and see if this will give you enough information to build the rule you need.

Audit Rule Video: https://assets.concur.com/concurtraining/cte/en-us/cte_en-us_exp_audit-rules.mp4

Audit Rule Guide: http://www.concurtraining.com/customers/tech_pubs/Docs/_Current/SG_Exp/Exp_SG_Audit_Rules.pdf

Hints: When you are building your rule, look for the option that says Amount Daily Total (multiple expense types). Your rule will have two conditions. One stating to look at the daily total (multiple expense types) and the second condtion is around the entry expense types of breakfast lunch and dinner. Lastly, to include all three expense types, your operator needs to be "in".

Good luck. Let me know how it goes for you.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Aryeh2b before I answer, I need to ask...are you currently working with someone from Concur on your site setup or have you already completed all of your calls with your activation coach?

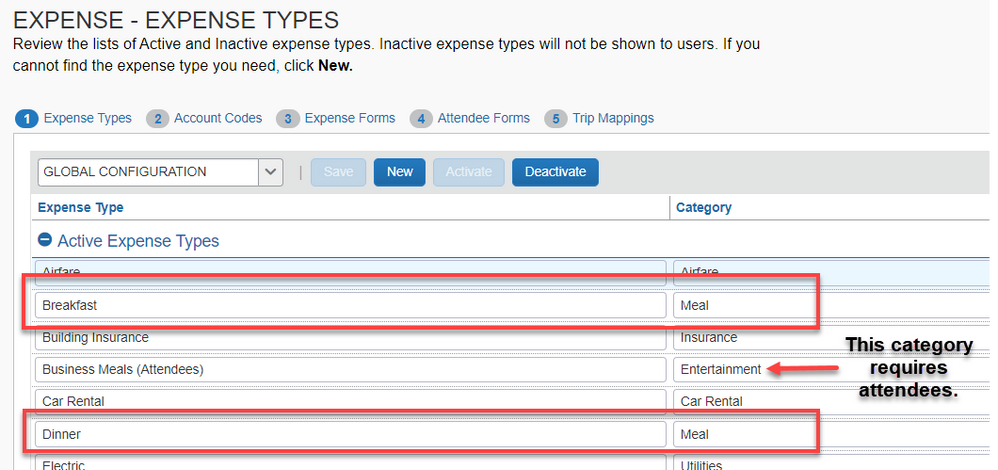

One thing I can say is that individual meals by default should not be requiring attendees. What that tells me is that someone changed these meals expense types into the Entertainment category. Go to your Expense types for Expenses screen and look at these expense types. If you go to the right, you'll see a Category column. I bet these meal types are set to Entertainment and not Meal. I've provided a screenshot.This should fix both of your issues.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

We have 1 more meeting with our activation coach, but between you and me he was good with basic setup but not so saavy with these more nuanced items we are trying to put in place. He advised that he had given me all of the permissions possible and only after i found out about audit rules and asked him did he then actiavte that functionality for me.

I apologize as well as i don't think my previous message was so clear and i will try and clarify it now.

The items are categorized correctly, but by defualt the entertainment category, which requires attendees, will allow the user to proceed if they choose themself as the only attendee. There is an option to "require attendees other than self", but when that is checked it then requires multiple attendees even when we make attendees optional, which is what i did for the meal category.

The second thing is how to make the system understand that the $100 cap is per employee so if multiple employees travel together the system knows how to track the $100 by person. I was able to adjust the rule to allow the cap to exceed $100 if an attendee was listed, but that isn't a perfect fix.

Again i would really like to reiterate my appreciation for your help as i try and learn the system.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Aryeh2b I've copied and pasted parts of your last reply. See my responses in red.

The items are categorized correctly, but by defualt the entertainment category, which requires attendees, will allow the user to proceed if they choose themself as the only attendee. There is an option to "require attendees other than self", but when that is checked it then requires multiple attendees even when we make attendees optional, which is what i did for the meal category. Why do you want the attendees section available for individual meals? The system was not designed for that, technically. If it were me, I would just turn off the Attendees section as the Meal category works off the assumption that these are individual meals.

The second thing is how to make the system understand that the $100 cap is per employee so if multiple employees travel together the system knows how to track the $100 by person. I was able to adjust the rule to allow the cap to exceed $100 if an attendee was listed, but that isn't a perfect fix.

I am not understanding how employees traveling together comes into play. Aren't they all just entering in their individual meals. I've traveled with employees but I still enter my own meals even we have gone to dinner together. I need a little more context as to what your employees are doing. It sounds like you aren't having employees use the Business Meal expense type when there are two or more dining together, but rather they still use Dinner as the expense type and enter additional attendees. Is that what is happening? If so, that isn't how the system is designed to work. A group meal, for most companies, should not be categorized as Breakfast, Lunch or Dinner. That is why we provide you with a default expense type of Business Meal (attendees). So, when you try to configure the site in a way that goes against its design, you run into the issue you are having. Is there a reason you don't want to use the Business Meal expense type when employees travel together?

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Thank you for clarifying. Let me expain how we think about it and maybe there is a better way to set this up in the system.

We look at meals while employees are traveling in 2 ways.

1. Employees having a meeting with clients. These are meals in whcih members of our firm are having meals with members of a different company. Obviously for these types of meals the attendees are required. We also do not count these meals towards their daily allowance. This is what we deem as a "Business Meal".

2. Employees having meals either by themself or with another member of our company if they are travelling together. If for example, Mike and Joe are travelling together and they go out for dinner whcih comes out to $100. Let's say Mike pays for the whole meal so from a reimbursement standpoint Mike should get reimbursed for the whole meal. From a daily meal allowance standpont, both Mike and Joe will have used up $50 towards their daily allowance. The rule we put in place combining breakfast lunch and dinner to total $100 works, but if Mike submitted that dinner bill for $100 the system would show him reaching the max even though if he listed Joe as an attendee it should only be applying $50 to Mike and he should have $50 remaining.

Based on what you wrote below you said that everyone should submit their own meals, but wouldn;t that only work if they each paid separately? I assume it is common for 1 employee to pay for multiple employees when traveling.

The other scenario we are trying to account for is if Joe now submits his own expense report, is there a way the system can know that he has already used $50 towards his daily cap even though it is part of Mike's report. Since Mike listed the attendees and the system splits the cost to each person the system would show Joe has a $50 dinner on a specific date.

If i should be thinking about this and setting it up differently please let me know.

Regards

Aryeh

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

First, the system will not know that Joe has used $50 if Mike put it on his report. It still sees it as Mike's expense. Adding Joe only tells the system that the total $100 wasn't just for Mike.

The way I see a meal with 2 or more people, no matter if it is two employees traveling together, it is a group meal and therefore a Business Meal. I am not sure what is more common for all our customers, but for me, even if I travel with a colleague, I pay separately unless I've gotten pre-approval. However, the pre-approval would be to count the meal as a business meal. This will then show for accounting a different GL Code to have it charged and accounted for as not part of the employee's daily allowance.

The other part is in your example of Mike and Joe. If the dinner is $100 and Mike pays for the entire meal, then Joe has not used $50 toward his daily allowance. How can employee use up $50 toward their daily allowance if they didn't pay for the meal. It doesn't make sense for one employee to spend money that would use up part of another employee's daily allowance. That is why most of our customers count two employees dining together where one employee pays the bill as a Business Meal expense.

Would it be possible to communicate to your employees that when traveling together they need to pay separately and if not, the total of the bill will count against the daily allowance of the employee who paid?

The nice thing about implementing a new Expense Reporting system, is the opportunity to create new company policies to match how the system works. 🙂

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi Kevin,

Can you help me with an issue that is similar to this forum topic?

My company currently has a per meal limit of $15/$20/$35 for breakfast/lunch/dinner. Our Concur system currently calculates the amount that is over each meal limit and allows accounting to easily deduct the balance from the employee's pay. We are looking to change our meal policy from a per meal limit to a daily total limit of $70. Concur support is telling us that if we make these changes, we will only receive a caution indicator that the daily balance of $70 has been exceeded, but the amount of overage cannot be automatically calculated. This situation would then require a manual calculation to determine the amount to deduct from the employee's paycheck. This would create inefficiencies in our system. Does this sound correct to you? There has to be a better solution to this issue.

Thank you in advance for your support!

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Jstephens A couple questions for you:

1. How does the system automatically calculate the overage? Have you built some sort of calculation audit rule or used some sort of validation?

2. Why not keep the current process as is since it seems to be working? What is the advantage to having a daily meal total rather than individual meal limits?

3. Have you considered using per diems/travel allowances? This could possibly eliminate any need to calculate an overage because it will calculate what the users daily limit allowance is and only reimburse that amount based on where they travel. Without any need to calculate the overage, then there is no need to deduct from a paycheck, which might be less work than your accounting team is currently doing. (Just a suggestion).

I think Concur Support is correct. The reason being is that currently the system is looking at an individual expense and calculating the overage, but with the new method it has to take in to account three different expense types and the aggregate of those three and compare it to a total. I believe with your current method, it is doing a one to one comparison of the expense type to a limit and calculating the overage. What you are looking for is a many to one, which personally I've never tested.

I do know that you can flag an expense report with a red exception if a user goes over their daily limit, it doesn't only have to be a yellow warning.

When I hear back from you on how you have the system calculating the overage, I can ask around and see if what you want is somehow possible.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi Kevin,

Thank you for responding! I believe the answer to #1 is that the system looks at the single amount submitted for breakfast lunch and dinner and easily computes the difference for each meal. Question #2- We wanted to move to the daily limit to add flexibility to eating preferences. Some people choose to skip breakfast or lunch and apply those amounts to dinner. We can't do that with our current configuration. Our current process evaluates each meal independently holds our employees accountable to the meal limits. Question #3- We have used per diems in past and it is easier however, we have a "no alcohol" policy and require receipts to ensure adherence to this policy.

It sure seems like there should be a solution to this issue. Thanks again for your response!