- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Is it Possible to Track Manual TAX/VAT Amounts Inp...

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Is it Possible to Track Manual TAX/VAT Amounts Inputs?

Hi Experts,

We have a case where the VAT/TAX amount from a specific expense type, outputted in the reports/integration, is different from what it is supposed to be. Testing an expense creation as the user, we see the VAT/TAX amount field is editable and there is no rule for blocking it, so any input is accepted.

Before thinking about audit rules or any other ways to block it, I was wondering if we may capture these manual inputs in the Intelligence Reports, where it would be clear that a specific entry/line had a manual input.

Thanks in advance!

Felipe

Solved! Go to Solution.

- Labels:

-

Configuration

-

Help

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@felipeprevente off the top of my head, I don't believe this is possible. I don't recall every seeing or hearing about the system tracking whether a field was auto-populated or manually inputted.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@felipeprevente off the top of my head, I don't believe this is possible. I don't recall every seeing or hearing about the system tracking whether a field was auto-populated or manually inputted.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi Kevin,

Thanks for your reply. I was looking for a field/entry on the reporting side, but it seems we don't have such a thing.

Regards,

Felipe

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi

did you get anywhere on your search?

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi,

No, I didn't. Unfortunately.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi @felipeprevente , cc: @SharronL

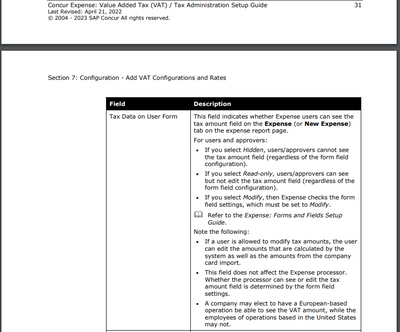

Just curious. I read you comment and get the impression that change of VAT/TAX amount field by the user is not expected/ to be blocked. Why not update the tax configuration to make the VAT/ TAX fields read-only or hidden to the user(s)?

http://www.concurtraining.com/customers/tech_pubs/Docs/_Current/SG_Exp/Exp_SG_VAT.pdf

Rohan Patil

SAP Concur Community enthusiast

✅Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi Rohan,

I do agree with you, and we have already made VAT read-only. But in this case, the goal was to capture expenses already processed with manual VAT inputs, where I wanted to know whether Intelligence has any field which tells us so.

Thanks for your response.

Felipe