- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Re: Ireland Enhanced reporting requirement of non...

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Ireland Enhanced reporting requirement of non taxable benefits

Hi

Does anyone know if Concur is doing anything to support the new Enhanced Reporting Requirements for Expense related non taxable benefits in Ireland, that comes into play from 1/1/2024.

If you have employees in Ireland, how are you dealing with this, especially working out tracking of the Small benefit limit of 2 non taxable benefits per year under €1000 ?

Thanks

Gill

- Labels:

-

Best Practices

-

How To

-

Reporting

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Gillybeans64 would you mind providing a little more information on what the enhanced requirement is for Ireland, please?

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hello Kevin,

I received this notification from the Finance team too, more details can be found here: https://www.revenue.ie/en/employing-people/becoming-an-employer-and-ongoing-obligations/reporting-ja...

How can we deal with this?

Thank you

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Thanks Crina, yes that is the best guidance on the requirement from Irish Revenue.

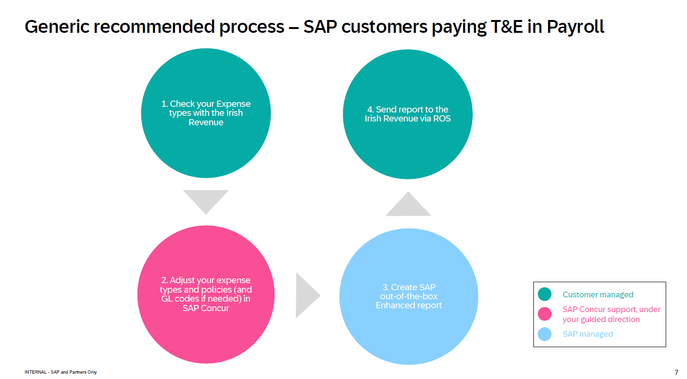

From an SAP Concur perspective if you don't use a SAP ERP system it is really just a case of creating some reports and all pretty manual. If you have have a SAP ERP system ( SAP or SAP S/4HANA) there is some expense type configuration required to use it , but there will be an Out of box enhanced report in the format needed to load into the revenue service system ROS

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hello,

We are using SAP, what Out of box enhanced report is needed? Could you please share more details?

We were thinking of using a Cognos report filtered on Payment confirmed.

Thank you in advance!

Crina

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Crina unfortunately I don't since I'm not familiar with Ireland specific reporting requirements.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi Kevin,

The new Ireland Reporting Requirement affects us too.

I am trying to create a custom report in Query studio.

I added all the fields as mentioned by the SAP Concur support, but we want to track only the configuration change related to Ireland ( corresponding only to a particular entity ). Therefore, when I tried to add the 'Ledger Code' field I am getting a Cross joins error. Is there a way to resolve it?

Thanks,

Medha S

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

I don't have a report name, it was just in a something shared by our Principal solution consultant at Concur, maybe reach out to your Concur consultant. They are definitely working on it.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Just wanted to let you both know that I'm meeting with someone tomorrow that is in the UK to discuss Ireland's requirements. She will provide me some information and I'll provide it here after I meet with her.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Gillybeans64 @Crina Hello! I spoke with Kevin on Friday. To get ready for the reporting requirement, we recommend submitting a Support ticket. The team will be able to recommend the best approach for your reporting needs based on how you reimburse your employees today. As part of the project, you'll be invited to review your expense types to ensure they are granular enough for the purpose of the reporting.

Regarding the tracking of the small benefit exemption, the report you setup can include the "small benefit exemption" expense type. This will however rely on your employees using the right expense types for those and will be for you to track "manually"... If you are looking for a better solution to address the tracking of the threshold for each of your employees, we invite you to consider our solution SAP Concur Benefits Assurance by Blue dot, which helps you automatically track, report and calculate taxable employee benefits around the globe, no matter what expense types were used by your employees. It is specifically designed to help you keep up with the increasingly complex government regulations and demands. Please do contact your Account Manager to find out more 🙂

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hello @Lucie-D ,

Thank you for your email, I submitted a Concur report and their reply was not helpful at all. I already created a report and wanted an advise, it seems that the Intelligence team must receive the requirements from us and they will create the report. Their latest reply is: "Please be aware that the estimate of the hours (cost) of the report is based on provided requirements. All the requests that we currently receive in regards to the Ireland Enhanced Reporting Requirement are handled on case by case basis and we are getting information from the clients in regards to the fields and format needed."

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hello @Crina

This is correct. There are 3 options:

- Build a custom report yourself with Analysis/Intelligence, which requires Cognos knowledge. Important: scheduling is not available for Analysis meaning you would have to manually pull the report every time you're about to make payments to your employees.

- Purchase a one-off custom report

- Request a custom report from your current Consultative Intelligence service

In all 3 options, we require your guidance on on the report requirements to ensure it fits your needs.

I hope that helps,

Kind regards,

Lucie

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

This impacts us too and we don't use a SAP ERP system.

I created a simple list report to pull the required Expense data out. It needs to be in Excel format so we can look up some additional HR data to enrich the file.

Our issue is that this report cannot be imported into the Revenue site as it must be in .XML or .JSON format.

I think are some conversion tools out there but its just too messy.

I'd like to capture the missing HR data in Concur so that we do not have to perform any transformation. That way we can either run it in .XML format and upload it to revenue, or maybe use API to integrate it.

I'm currently looking at where we can store the missing employee information (PPS number, DOB, and Address) but cannot find anywhere suitable for the address. may need to be a Custom field.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

I'm wondering if we can use an API to integrate Concur with our payroll software.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hello,

We are also impacted by this. It is my understanding that Concur was working on an integration to allow direct reporting. Is anyone using this feature and/or has more information?

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi, does Concur provide step by step guidance on this. I'm trying to promote Concur to a customer and the above doesn't really help too much. Is there some written guidance and an out of the box free Cognos report the clients can use as part of implementation support ? Rather than an additional cost ?