- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Re: How do you handle recepit affidavits?

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

How do you handle recepit affidavits?

We're excited to see what other clients say, but SAP Concur recommends ensuring you’re capturing missing receipts with a signed affidavit. We encourage moving away from paper and use the Missing Receipt Affidavit function in Concur Expense. You will benefit from the Missing Receipt Audit Report (folder: Expense Processing).

- Labels:

-

Best Practices

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Using affidavits? Ensure your users do not think it is an excuse to not use original receipts. Create an audit rule that alerts the approver when a receipt affidavit is used.

Remember, if you reclaim VAT, it is highly likely that your tax authority does not support an affidavit as evidence of expense and tax paid.

KR

Angus

Angus Irvine Robertson

Head of CSI Customer Office, SAP Customer Support & Innovation

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Receipt Affidavits are an essential part of the setup used to eliminate paper.

In case, the workflow is designed to only send expense reports for manager approval/Audit in selected scenarios, it is a good idea to make the use of Affidavit as one of those scenarios. It should be straightforward to enable this behavior by adding a condition to your workflow (in case one does not exist) and adding an Audit rule with the exception level specified in the workflow.

VAT setup will probably need adjustments to post zero VAT or non-recoverable VAT in case an Affidavit is used.

Don't forget to translate the Affidavit text in case your users use languages other than English.

Most recently we recently implemented this for a client having users in Russia and Ukraine. It helped eliminate a paper-based offline approval process that we uncovered during a post-implementation process review.

Rohan

SAP Concur and SAP FICO Implementation Functional Consultant

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi Rohan,

Thanks a lot for your feedback. Could you please share the steps on how to set the VAT setting to post zero VAT or non-recoverable VAT in case an Affidavit is used....or is there a doc to explaine these setups?.

I look forward to your feedback.

Thanks

Dimitrios

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi Dimitrios,

There are a number of ways you could approach this, but I think an Audit Rule is probably the simplest and most straight-forward.

For most customers the recoverable VAT is calculated using the Receipt Status field. This field is a system drop-down with three possible values: Tax Receipt, Receipt, and No Receipt.

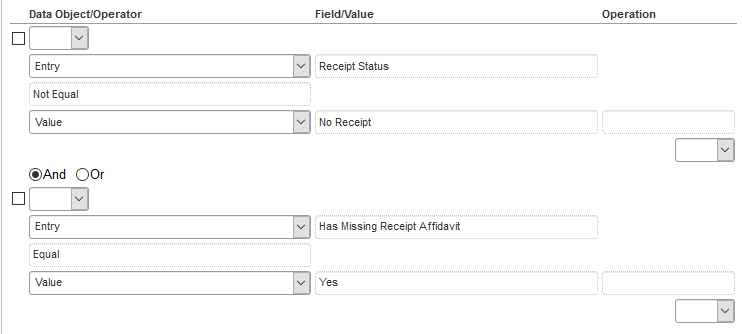

Logically, if the user says they have an affidavit they should not be allowed to set the Receipt Status to Tax Receipt or Receipt. We are going to do just that with our Audit Rule.

When creating the rule use the Entry Save event and create two conditions:

Receipt Status <> No Receipt and Has Missing Receipt Affidavit = Yes. Here is a screenshot:

Then set the Exception to be a red flag with a message indicating that when using the Missing Receipt Affidavit they must choose a Receipt Status of No Receipt.

I have to be honest and say I have not tested this, but it should work, but I'd still test it before rolling it out to your live users.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi Grant,

Thanks for your feedback.

But that does not answers my question requiring Rohan to share the steps on how to set the VAT setting to post zero VAT or non-recoverable VAT in case an Affidavit is used..

Best Rgds

Dimitrios

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

We do use the missing receipt affidavits within Concur. We also run monthly reports looking for employees who are abusing this option.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

I am looking to create a report for pulling who/how many times receipt affidavits are being used. I thought there was a standard report for this but cannot seem to locate it. Any suggestions?

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@nancylmeyer In Concur Intelligence Reporting, create a custom report that includes Expense Report Line Item detail. Add a filter where [Expense].[Entry Information].[Has Affidavit] = 1

This report will return the Expense Report and Line Items where the Missing Receipt Affidavit has been selected on the Expense Report.

Tom

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

HI, in the very first post it mentioned how to get the report.

it's under "expense processing" under your reports tab > standard reports (if you have it enabled).

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

If we see an employee utilizing the MRA more than 4 times, we send an email reminder with their usage from the report in the body of the email. We emphasize that the affidavit is to only be used in the RARE instance of a lost receipt, and further include information on Expenseit Pro to help minimize future issues.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

What criteria do you use to indicate potential abuse? Categories, quantities, amounts etc. Thanks!

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

ค๓๒єг ɭєє - ᴄᴏɴᴄᴜʀ ᴄᴏɴɴᴏɪssᴇᴜʀ

(っ◔◡◔)っ ☆ Fort Worth, Texas ☆

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

We make our Lost Receipt Affidavit difficult. We have it posted on our myTravel intranet site, not automated. We make it difficult because we want them to use mobile or attach correctly.

We also track number of affidavits per associate.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

How do you enable the Receipt Affadavit function in Concur? I am looking to begin using this.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Turning the feature on is done differently depending on what SAP Concur platform you are on. Are you using SAP Concur Standard Edition or SAP Concur Professional Edition? Once you tell me this, I can tell you how to turn it on.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi There,

We are using: SAP Concur Professional Edition.

Thanks and rgds

Dimitri

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

You can click on affidavit option while creating workflow

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Looking for new opportunities!

Anaren, Inc. - Travel Manager - Syracuse, NY

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

I'm curious how companies handle the MRA when the employee does not have access to Concur (e.g. production floor employees) and a delegate is preparing the expense report since delegates can not use the MRA. We've considered adding an attachment MRA but then we can't track the use of MRA.