- Home

- :

- Product Forums

- :

- Concur Expense

- :

- How do I mark the portion greater than 20% of grat...

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

How do I mark the portion greater than 20% of gratuity as personal expense and resubmit my expense?

My expense report was rejected because a tip was greater than 20%. I now need to mark the difference as a personal expense but don't know how.

Solved! Go to Solution.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

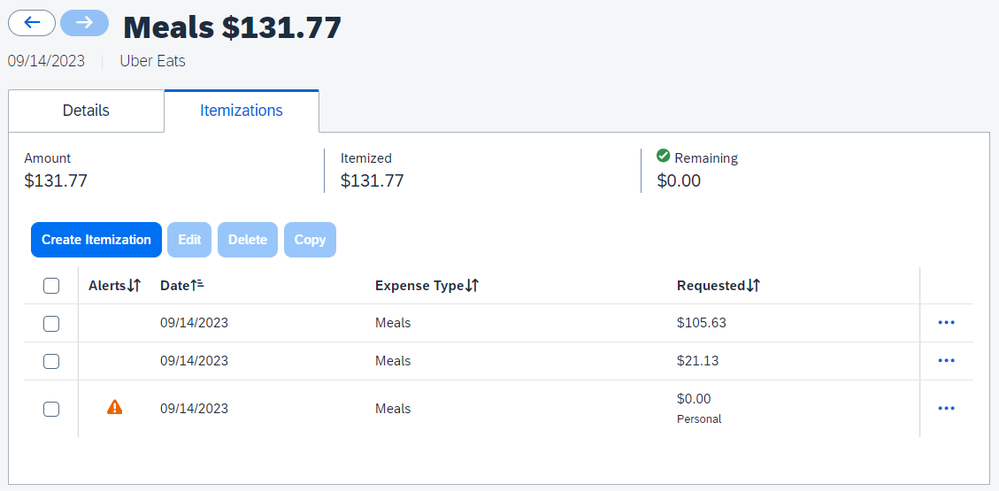

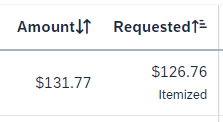

You can do this in the itemization tab. See the attached example, I did a line for the original charged amount, tip up to 20%, and the amount exceeding 20% was marked as personal. Then when it's saved, the requested amount will not include the tip exceeding 20%.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

You can do this in the itemization tab. See the attached example, I did a line for the original charged amount, tip up to 20%, and the amount exceeding 20% was marked as personal. Then when it's saved, the requested amount will not include the tip exceeding 20%.