- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Help setting up taxability/deductability

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Help setting up taxability/deductability

Hi Concur Community,

I am working to implement Poland and their tax GL code set-up is quite complex. could you help me to understand how I should set-up taxability/deductibility? I tried reading the technical docs but its still unclear to me on how should I configure this.

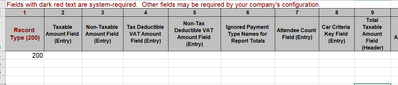

I am not sure what to put in template 200.

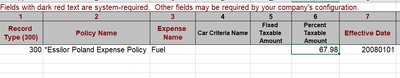

and in the accounting structure. will it create another expense type (Fuel - Taxability, Fuel - Nontaxable) once I import this file to accomodate 2 GL codes?

Appreciate if you could help me

Regards,

L J

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

dear @LovelyAsmolo

this is a technical question which I would hope your Concur Account Manager could address you on the specific and coordinate with your IT/IS department as it would impact the needed setting for transfer the file from Concur to your ERP system. I guess you contacted only the concur support by ticketing, which fairly enough they provided you with the file and the standard instructions which if you are not familiar with other settings it would be a risk to mess up without step by step guidance.

If you are not able to get an answer still, let me know. Thank you.

Kind Regards

Alessandro Munari