- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Expense Report Issue

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Expense Report Issue

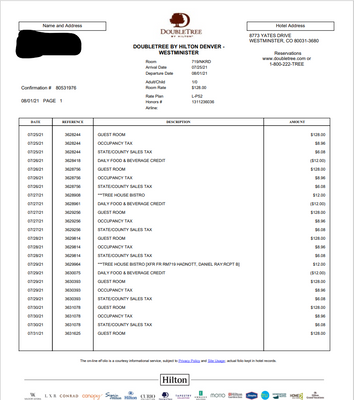

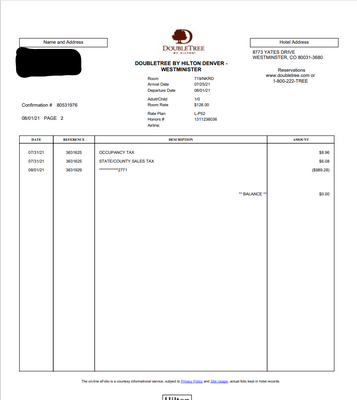

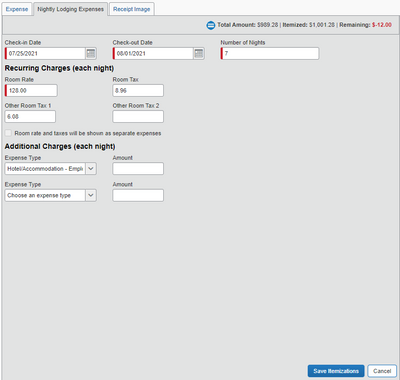

I'm running into an issue with a credit that Hilton is offering. I've applied the room rate and room taxes, but I am showing that I am over on my expenses by $12. I believe this is coming from one of the meal credit charges. However, I cannot credit this charge. Concur only allows me to adjust charges that are applied for each night. Not sure how to remedy this. Any suggestions?

Solved! Go to Solution.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi. I would suggest doing it as an itemization but not on the nightly lodging tab as that only for reoccurring charges.

Save it with the -12 then it should prompt you to chose an expense type within the Hotel parent expense because you are still out of balance.

Have a great day

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi. I would suggest doing it as an itemization but not on the nightly lodging tab as that only for reoccurring charges.

Save it with the -12 then it should prompt you to chose an expense type within the Hotel parent expense because you are still out of balance.

Have a great day

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@dhadnott I looked at your report and your receipt. What you can do is enter a single expense itemization for a meal. This would account for the $12 Treehouse Bistro charge that appears on your bill, but was accounted for in your daily meal allowance from Hilton. Once you add in this $12 individual itemization, it will zero out the total. To add this itemization, open your expense report, click on the Doubletree expense entry. When the details appear on the right, look for an Add Itemization button at the bottom of the details. Select a meal expense, enter 12 as the amount fill out any other required fields, then save. That should do it.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.