- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Expense Pay and Credit Card/Company Paid Expenses

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Expense Pay and Credit Card/Company Paid Expenses

We are implementing Expense Pay for US and Canada; for payment types we have 3 options:

1. Out of Pocket

2. Corporate Credit Cards

3. Company Paid Expenses

When submitting Expenses, the users should only be paid for out of expenses; the other 2 types should be excluded in the Expense Pay batches since these are paid directly by the company and the user submitting should not be reimbursed.

Is there a setup in Concur that would allow only for Out of Pocket Expenses to be reimbursed by Expense Pay and exclude the other 2 types?

Thanks,

Nimmi

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

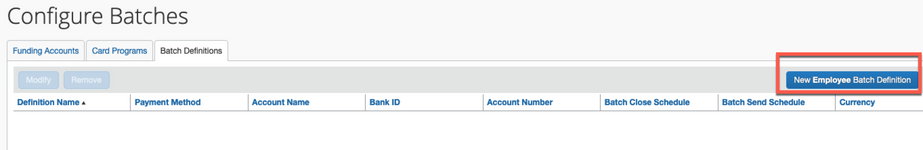

@nimmikatta when your Expense Pay batches get setup, there is an option to create an Employee Batch Definition, which is for paying out of pocket expenses.

There is a separate button if a company wanted to use Expense Pay to pay off corporate cards.

Are you working with someone at SAP Concur to implement Expense Pay?

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi Kevin,

Currently, we have a concur specialist assigned and are being told that once a user profile is set to Expense Pay, the Payment Type(Out of Pocket, Corporate Credit Card or Company Paid) does not matter. If the user is set as Expense Pay reimbursement in their profile and the report/line is not marked Client Paid or Personal Expense - Do not Reimburse, the user will be reimbursed. This cannot be modified on a report by report basis. But based on what you are saying looks like there is an option to exclude transactions? Could you share a user guide on how these transactions can be excluded? Happy to jump on a call if it's easier to show you how things are currently set up.

We just set up the funding account this morning so waiting on approval.

Thanks,

Nimmi

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@nimmikatta If an entry is marked as Personal or Company Paid, it wouldn't be included in the amount to be paid to the employee. So, in a sense it would be excluded. Does that make sense? I wouldn't say that once a Group is assigned Expense Pay the payment type doesn't matter. It actually matters quite a bit. If Company Paid is a payment type option your users can choose from the Payment Type drop down, then that would tell the system not to reimburse the user the amount of that expense. Now, your system will be set up to default any new expense entry to the Out of Pocket payment type, which is probably what you want. You just need to be sure to educate users on what will happen if they choose Company Paid by mistake.

The good thing is, if there isn't any occasion when they should choose Company Paid (this payment type cannot be hidden), you can create an audit rule that would block users from submitting expenses with this payment type. If there are occasions where Company Paid would be used, your audit rule could be set to warn/remind them to check the Payment Type, but would allow them to submit.

Since you are not integrating a corporate card, your users should be entering all their expenses as out of pocket, correct? All you need is an Employee Batch Definition set up that uses Expense Pay. This will reimburse your employees for all out of pocket expenses. Once your funding account is approved, you will need to use the Configure Batch option to set up the Employee Paid Batch. See screenshot. Let me know if you need me to clarify anything.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Also, I wanted to mention that we don't have a corporate credit card integration set up.