- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Re: Concur Expense calculation policy - So frustra...

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Concur Expense calculation policy - So frustrating and outdated

Hi,

Let me share the frustration story with concur expense. I had a travel where air fare is paid by company. So I billed two

1. My personal expense $2490.36. At the line it showed that refund amount is $2940.36.

2. The other one is air fare and I selected as personal expense before submitting. Otherwise concur was showing that owing to employee is $971.44. I did not want get that paid to me that's why I selected personal expense.

Now the funny story begins, what concur did, it subtracted $971.44 from $2490.36 and sent payment $1518.92. But nothing is updated in the all the reports. Concur considered that $971.44 is paid by company and I mentioned that it is personal expense. So $971.44 should be subtracted. What a fool! do company pay by air fare or some there form of compensation? It is completely illegal. Concur should add that. I mean it should flag it and notify before sending the final value.

Now I created another expense exact amount of air fare. Lets see how Concur handle that. Whoever behind the expense policy need to study more, need to go back high school again.

Regards,

Aurangozeb

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@fnua I did a little bit of looking around in your company's SAP Concur site. From what I see, Airfare is paid for on a company credit card. And from the message in the Company Notes section (pictured below) you are to include the Company Paid airfare on your expense report, which I see you did. Since it is company paid, you do not mark it as a Personal Expense. The Company Notes message does not say to mark it as personal. Company Paid expenses will not be reimbursed to employees.

Next, you then added two airfare expenses to a separate report. The payment type for these two airfare expenses is Personal Credit/Debit Card. This payment type tells the system that you paid for the airfare (not your company) and are requesting reimbursement. However, the company has already covered the cost of the airfare. Should you be asking for a reimbursement?

The system is designed to recognize company paid expenses and not reimburse the employee for them. Although it appeared that the Requested amount was for $971.44, you were not going to receive that money.

The $971.44 subtracted was because you marked the Company Paid airfare as personal which tells the system that the airfare wasn't used for work, but for personal reasons, so the system had to pay the company back and "did the math" automatically by reducing the amount you were to received to $1518.92.

I believe the system did do the math correctly based on what you told it. 🙂

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Every one knows how to do subtract, before replying pleas read the question thoroughly. When system subtracted $971.44, it assumed that company paid its employee something through air fare not by regular salary to bypass the tax, which is not allowed. So system should flag it before finalizing.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@fnua I'd like to pose some questions to you. I'm not asking to be argumentative, but rather to see how this situation could have played out differently. Was the airfare in question used for business or for personal? If for business, why did you mark it as personal? If for personal, does your company usually pay for their employees' personal travel without expecting to be paid back? Lastly, what do you think would have happened had you combined the company paid airfare on the same report that totaled $2490.36 AND you didn't mark this airfare as personal? What would your reimbursement total have been?

As for bypassing taxes...when employees are reimbursed for business travel or if the company pays for airfare for an employee to conduct business, that isn't considered compensation because the employee isn't getting any monetary or personal gain. Reimbursements and company paid expenses are not subject to taxes like a paycheck. I can assure you our system is designed to ensure companies are compliant with local tax laws.

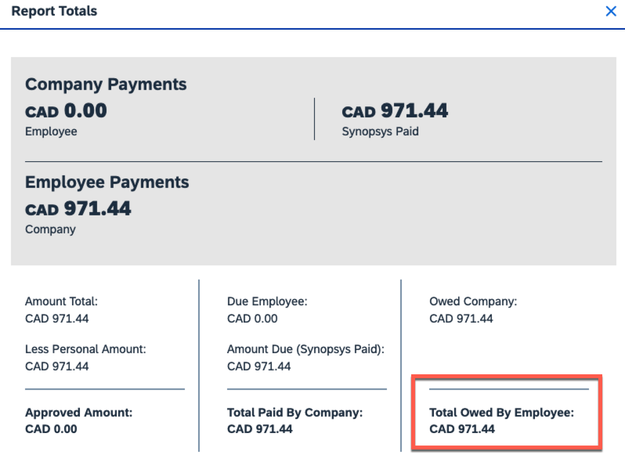

As for the summary totals you mentioned, had you combined the airfare expenses on the same report with the other trip related expenses, you would have seen more accurate totals. The system can only show totals of the report you are viewing, not totals of multiple reports. Also, if you open the report with the company paid airfare you marked as personal and go to Report Details>Report Totals, you would see that there is an amount for Total Owed By Employee in the amount of 971.44. It shows this rather than -971.44 Owed to Employee. I've provided a screenshot for you. Technically the system is correct in that you were owed zero dollars because you are the one who actually owes the company money by telling the system the Company Paid Airfare was for personal use.

I'll await your responses to my questions above.

P.S. In all fairness, your company, in my opinion, should not have allowed Company Paid expenses to be marked as personal. They could have hidden this field or created a rule to prevent this. Had they done this, you wouldn't have had this situation. Maybe suggest to your site admins they look into this. 🙂

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

One more thing, the summary report should show -971.44 (due to employee) other than zero. and 1518.92 other than 2490.36 . This is also misleading. So the system has a major flaw.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

When an item is Company-paid, it does not reimburse the employee but separates it on the payments drop-down, just as Kevin said. If you mark a company-paid item as personal, it will subtract it from your reimbursement. Company-paid should not be marked personal unless you actually used a company card for a personal charge. The summary report does not show less than $0 amounts, so if a credit is company-paid, it will show $0.

Agfa