- Home

- :

- Product Forums

- :

- Concur Expense Forum

- :

- Audit rule for expat expenses

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Audit rule for expat expenses

Hello Dear community,

We are trying to prevent an expat issue.

Our major issue is when employees in one country, with one reimbursement currency, submit expenses paid via a corporate card for another currency after a long- term assignment, we want to prevent prevent employees from submitting such reports.

Does anyone is dealing with this situation?

Do you use an specific rule to prevent this reports to get approved?

Appreciate your guidance!

Thank you,

Regards.

Abigail

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Abigail_Silva Hello there. I'm not sure I quite understand your need. Why do you want to prevent them from submitting these expenses? If they are indeed business expenses, why don't you you want them submitted?

Also, how is the reimbursement currency of the employee different than the currency of the credit card? What are the currency in question? Is the issue that the currency of the employee isn't the same as the credit card?

I'm just a little confused on the situation and why these employees shouldn't be allowed to submit these expenses if they are business expenses.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Hi Kevin,

Thank you for your questions.

For example, an employee from India gets assigned for a long - term to US. His profile is under the US - GL codes do to the change.

When he comes back to India he must use the US Credit Card to cover his expenses.

His payroll and GL accounts will change when he comes back to India do to the realocation changes, altought they have 2 weeks to submit their expenses we face with this:

1.- Transactions that arrives latter than expected are submited by the employee on a report which is associate to the new India GL accounts and when it gets approved the SAE file get stuck in the interface because of the currency issues / convertion ( US / INDIA CURRENCY) and unmatching GL accounts, we manually remove the expense an paid via AP directly to the bank.

Which is a time consumming activity and is not effective and i`m working to find if it`s possible to create a global rule for that.

Thank you!!

Abigail

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@Abigail_Silva I am thinking that @JessicaL suggestion of just giving more time before switching the employee back to the India GL. I think this would be the least amount of work all around.

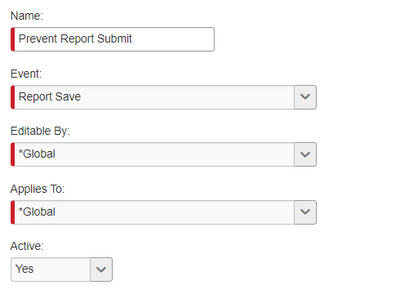

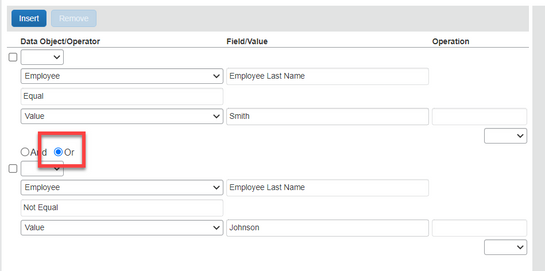

However, if this is not an option, you could also deactivate the user's profile until the charges are cleared. Alternatively, you should be able to create an audit rule that would prevent report submission. I've provided two screenshots of how the rule could be set up. In the second screenshot it shows preventing one single employee. I just used Smith as an example. You can enter any employee's last name here. You would need to add more conditions to include the names of anyone else that needed to be prevented. Just be sure each condition for each employee uses "Or". I've included that in the screenshot. Once you add the conditions, be sure the exception level you set up is a 99.

I hope this helps.

Thank you,

Kevin

SAP Concur Community Manager

Did this response answer your question? Be sure to select “Accept as Solution” so your fellow community members can be helped by it as well.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

You could make a second profile for the employee for their Ex-Pat experience so the two do not cross over at all. Or, you could allow for a longer period of time than 2 weeks. Some vendor transactions (airlines, hotels) can take up to 8 business days to come into Concur, so 2 weeks does seem rather short.

But, much of our follow-up was manual - if we knew there was this situation upcoming, we would Proxy in to their Concur account every Friday to make sure the US expenses were submitted. When their US credit card was at $0.00, then we would convert the employee back to their previous location in Concur.

The situation is definitely complicated.

Travel and Expense System Administrator