- Home

- :

- Resources

- :

- Admin Resources

- :

- Maximize Your Solutions

- :

- Automation Brings Support for Finance Compliance t...

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

Automation Brings Support for Finance Compliance to Growing Businesses

The impact of intelligent technology runs even deeper in midsize businesses than most people think – especially when finance organizations automate their audit and compliance programs to help offset resource constraints.

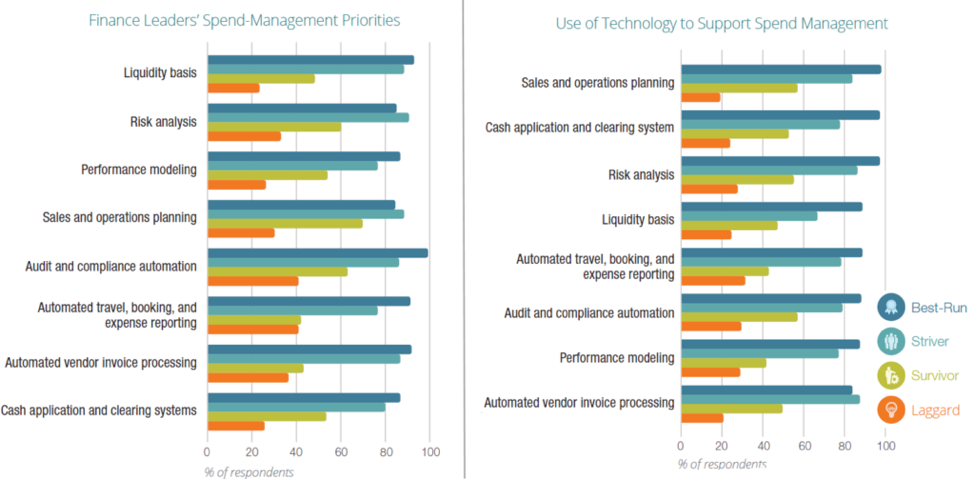

In fact, according to the IDC InfoBrief, “The Finance Role in Best-Run Midsize Companies: Improving Decision-Making Using Intelligent Technolo...,” sponsored by SAP, nearly 100% of best-run finance organizations cite audit and compliance automation as a high priority. And more important, upward of 85% are using technology to reduce rogue purchases, fraud, and audit risk; improve spend management and control; and uncover insights on organizational spend.

Source: “The Finance Role in Best-Run Midsize Companies: Improving Decision-Making Using Intelligent Technolo...,” IDC, sponsored by SAP, February 2019.

Growing adoption of technology for audit, compliance, and security management

The critical nature of audit and compliance programs requires company-wide commitment and strategic direction from organizational leadership. Otherwise, the business is no more than a rudderless ship prone to be hit with every wind and wave of disruption that might topple it.

With a navigation style rooted in logic and sequential thinking, most finance organizations in midsize companies are well-positioned to adopt intelligent technologies to automate audit and compliance processes as well as security management. For example, machine learning reduces mundane tasks and increases workforce and process agility. Digital assistants empower users to focus on what matters most to the customer and the business. Meanwhile, predictive analytics help employees concentrate more on present and future outcomes, rather than those in the past. And replacing traditionally manual controls with those that are fully automated reduces the cost and fatigue of internal and external audits.

Using intelligent technologies enables finance organizations to build on their reputation for providing strong support to the business. They can expand the application of transparent and trusted business intelligence while keeping data protected from inappropriate access and fraudulent use. Finance leaders can partner with all non-finance areas to identify risks, develop well-rounded opportunistic strategies, and handle disruptions without negatively impacting another function.

For example, with the use of intelligent technologies, finance can empower lines of business to address realities such as:

- Rapid onset and diversity of risk events and potential for significant losses

- Stakeholder pressure for a more reliable view of risk tied to company objectives

- Relentless cyber threats that call for better protection of sensitive information

- Expanding global reach and complexity of regulatory requirements

Fostering digital trust to deliver outcomes that matter

Adoption of intelligent technologies, especially for midsize businesses and their finance teams, is the key to timely action, decision-making accuracy, and fully informed insight. Once insights from those innovations are derived and operationalized through automation, finance organizations can allow the rest of the business to get ahead of auditing and compliance challenges without trading off business efficiency, quality, and growth.

This article originally appeared on Digitalist Magazine Online.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.