- Home

- :

- Forums

- :

- Additional Products

- :

- Re: Audit Rules

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

Audit Rules

What audit rule have you written that you have found most helpful or you wish you would have had at implementation?

This question comes from our LinkedIn group.

One of the top audit rules is how you prevent (or don't prevent) submission of an expense report based on violations. While a “hard stop” submission process will not allow the user to submit an expense report that is out of policy or not complete, a “soft stop” approach can be seen as more user-friendly. For example, you can block (hard stop) an expense report from not being submitted if it includes an un-itemized hotel bill. However, a “soft stop” would allow a user to submit an expense report even if it didn’t include receipts for expenses under $25, and instead might alert the manager or target them for audit.

- Labels:

-

Audit Service

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

We have placed a hard stop on weekend use of Taxis and Rideshare services. The required action is to enter a comment as to why the service was undertaken. The reason could be quite legitimate - i.e Taxi to airport to catch a Sunday evening flight to Sydney to attend early morning meeting or conference on Monday. It's a good deterrent to anyone thinking about using the company card to supplement a boozy weekend night out!

Assistant Director, Business Services

Australian Bureau of Statistics

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

We have 5 coding / cost tracking fields that are required at the Expense level for every expense that is submitted. At the Allocation level, these 5 are optional, as less than 5% of all expenses submitted are allocated. However, if someone allocates an expense, they could submit it without all 5 cost tracking fields filled out. This creates accounting issues, as allocations override expense level details.

To fix this, we created an Audit Rule to block submission of the expense if a) it's allocated and b) any of the allocation cost tracking fields are blank. With the new UI, it looks like allocation fields are auto-populated (maybe they could have been before, but we just had a setting turned off - I don't know), so this may not be a big issue, but it's nice to have the failsafe if someone is trying to do that. Usually they simply forget, they're not trying to be malicious or anything.

Another we've implemented is if a user tries to submit a report with only cash expenses on it and the report total is zero, it blocks submission. We've had cases where a user will have no credit card activity for a month, but they still submit a report with just their bank statement attached, showing they had no activity. Per our policy, that is not required, and just takes up an extra slot in our quota, so we put this rule in place.

We do our best with training and support, but we don't live in a perfect world, do we? 🙂

Josh

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

We track R&D expenses for tax purposes. Each R&D project has a code. We’ve added an expense type called “Project Expense.” If using this expense type, allocation is required. The allocation field is free text so the user can enter the project code. Each month, our controller receives a report of all expenses charged to that expense type, along with the code associated with it.

Looking for new opportunities!

Anaren, Inc. - Travel Manager - Syracuse, NY

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

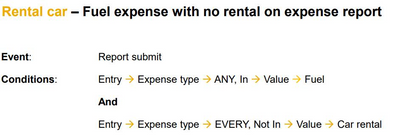

I have implemented Concur for a lot of companies and there is one audit rule that I like to create for my clients that does not come already created with a new system. It is when there is Rental car - Fuel expense but no rental on the expense report. Here is how I configure it:

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

@CraigPeay do you set the rule for a hard stop or only a warning? Sometimes we see the scenario where traveler forgets to add rental car fuel on the first ER with a rental car then submits a 2nd ER for the fuel expense only, a few weeks later when they remember the fuel.

This content from the SAP Concur Community was machine translated for your convenience. SAP does not provide any guarantee regarding the correctness or completeness of this machine translated text. View original text custom.banner_survey_translated_text

- Mute

- Subscribe

- Bookmark

- Report Inappropriate Content

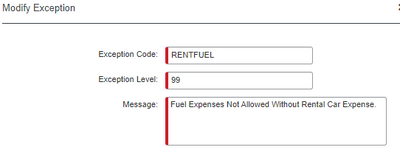

@scoathy Good Morning, I make it a hard stop. Here is how I configure it:

You can always adjust it to meet your needs.